Idaho Governor Brad Little has signed a NAIFA-promoted best interest bill into law. The bill, HR 79, is based on the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transaction Model Regulation.

2 min read

Idaho Enacts Enhanced Protections for Annuity Consumers

By Julie Harrison on 3/17/21 2:15 PM

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Idaho Insurance & Financial Advisor Regulation

1 min read

NAIFA-MT Promotes Favorable Auto Insurance Ratemaking Bill

By Julie Harrison on 3/17/21 1:58 PM

The Montana State Legislature is considering a bill that would end the state’s practice of treating all people, regardless of gender, the same by insurance companies when setting rates and product offerings.

Topics: State Advocacy Grassroots Montana Underwriting & Risk Classification

1 min read

NAIFA-MN Testifies Against Problematic Paid Family Medical Leave Bill

By Julie Harrison on 3/15/21 2:45 PM

NAIFA-MN opposes a bill that would create a state-wide paid and family medical leave insurance program in Minnesota, HF 1200, which is under consideration in the state House.

Topics: State Advocacy Grassroots Minnesota Paid Family Medical Leave

1 min read

NAIFA-ME Connects Producers and Lawmakers at Virtual Legislative Breakfast

By NAIFA on 3/12/21 9:12 AM

NAIFA-Maine’s virtual Legislative Breakfast on March 9 featured video conference meetings connecting NAIFA members with state lawmakers whose policy decision impact the businesses of insurance and financial professionals as well as the consumers they serve. Legislators in attendance included:

Topics: State Advocacy Grassroots Legislative Day Maine

1 min read

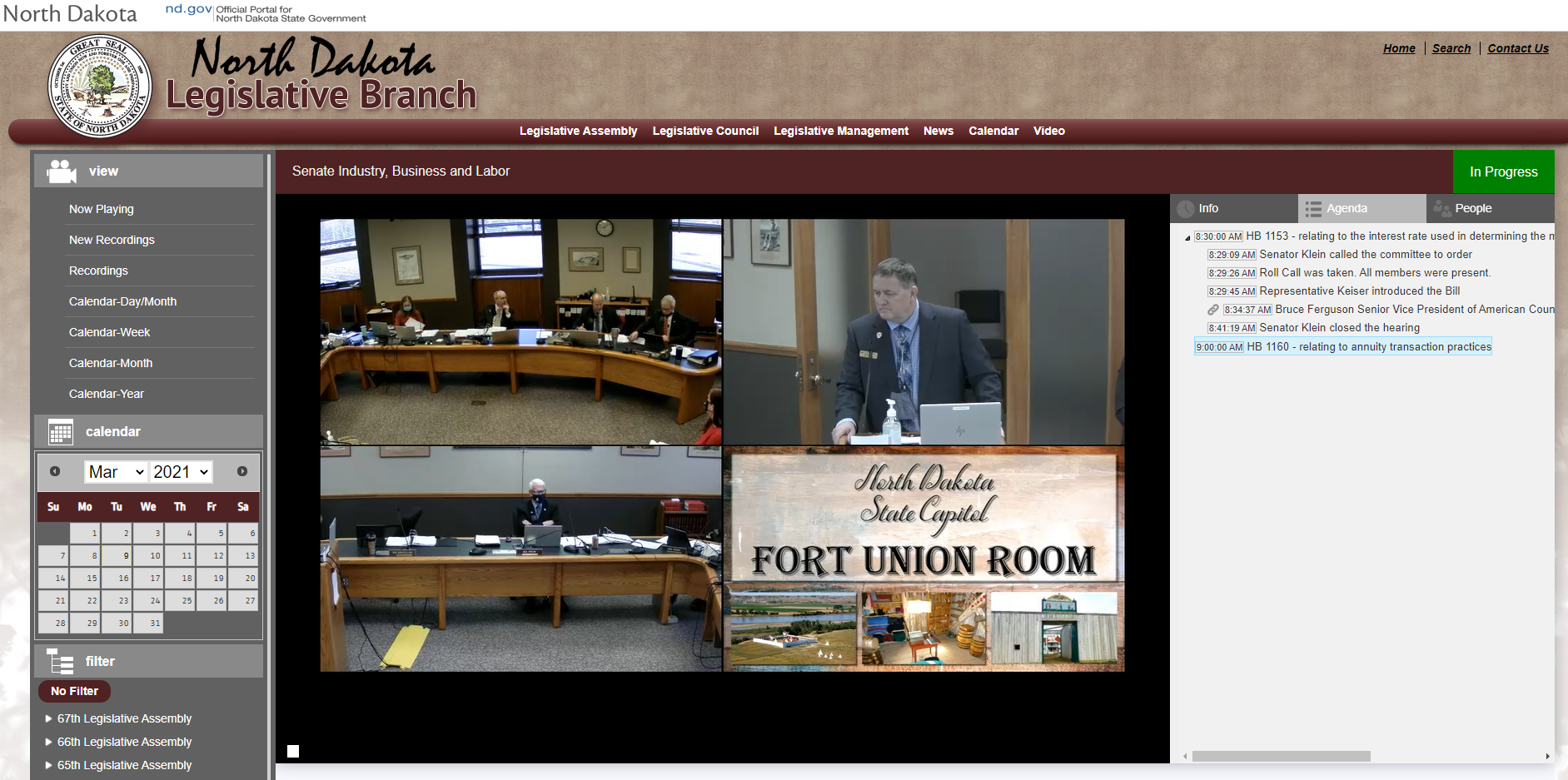

NAIFA-ND Tells Lawmakers Their Clients Come First

By Julie Harrison on 3/9/21 3:35 PM

NAIFA-ND President Lyle Kraft testified at the State Senate Industry, Business and Labor Committee on March 9, on the importance of passing an important new best interest standard.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest North Dakota Insurance & Financial Advisor Regulation

1 min read

NAIFA-TX Holds Successful Virtual Day at the Capitol Advocacy Event

By NAIFA on 3/3/21 5:02 PM

NAIFA’s Texas chapter (NAIFA-TX) held a successful legislative event last week, with several dozen participants. The annual Day at the Capitol was planned as a hybrid event, with both in-person and virtual attendees. However, the lingering effects of recent winter storms required NAIFA-TX to quickly shift to an all-virtual event.

Topics: State Advocacy Grassroots Legislative Day Texas

1 min read

NAIFA-Wisconsin to Hold Virtual Day on the Hill Political Advocacy Programs

By NAIFA on 3/3/21 4:13 PM

The Wisconsin chapter of the National Association of Insurance and Financial Advisors (NAIFA-WI) will present its annual Day on the Hill advocacy programming March 8 and 10. The virtual event will highlight the importance of political advocacy for insurance financial advisors. Decisions by state lawmakers and regulators have tremendous impacts on the businesses of NAIFA members as well as the Main Street consumers and small businesses they serve.

Topics: State Advocacy Wisconsin Grassroots Legislative Day

1 min read

NAIFA-TN Urges End of Professional Tax on Advisors and Broker-Dealers

By Julie Harrison on 3/2/21 3:55 PM

NAIFA-TN is using its advocacy muscle to convince state legislators to eradicate its professional privilege tax. The tax was used to balance budgets in 1992 and in 2002 and Tennessee is one of only six states with such a tax. Until two years ago, the tax applied to 22 different professions, including dentists, physicians, and real estate principal brokers. In 2019, Tennessee removed the discriminatory tax on 15 of the professions yet continues to require attorneys, securities agents, broker-dealers, investment advisers, lobbyists, osteopathic physicians, and physicians to pay the annual $400 tax.

Topics: State Advocacy Grassroots Producer Licensing & CE Tennessee

1 min read

NAIFA-WI Objects to Proposed Layers of Data Privacy Regulations

By Julie Harrison on 3/1/21 2:42 PM

NAIFA-WI joined other trade associations representing the insurance and financial services industry to push back on a potential regulatory proposal that would complicate existing data privacy and security laws.

Topics: State Advocacy Wisconsin Grassroots Privacy Data Security

1 min read

NAIFA-FL Holds a Virtual Legislative Day

By NAIFA on 2/24/21 9:33 AM

NAIFA-Florida’s Virtual Legislative Day on the Hill was February 23. Approximately 80 participants joined the event and received legislative and regulatory updates as well as advocacy training from NAIFA-FL President Craig Duncan and state lobbyist Tim Meenan of Meenan P.A. Other speakers included Florida Insurance Commissioner David Altmaier.