Over the last two years, NAIFA-CT worked diligently with state legislators supporting legislation to provide Connecticut residents unlimited protection from creditors of the cash value of life insurance. The bill ran unopposed through a public hearing in June. It then passed the House and Senate and on July 12, and Gov. Ned Lamont signed it into law.

Julie Harrison

Recent posts by Julie Harrison

1 min read

NAIFA-CT Secures Unlimited Protection From Creditors for the Cash Value of Life Insurance

By Julie Harrison on 7/29/21 9:06 AM

Topics: Life Insurance & Annuities State Advocacy

1 min read

NAIC Committee Adopts Best Interest Model FAQs

By Julie Harrison on 7/23/21 5:00 PM

The NAIC Life and Annuities (A) Committee recently adopted the frequently asked questions (FAQs) regarding the best interest model adopted by the Committee in February of 2020. As most NAIFA members by now already know, the updated model clarifies that all recommendations by agents and insurers must be in the best interest of the consumer and that agents and carriers may not place their financial interest ahead of the consumers’ interest in making a recommendation. In addition, the model now requires agents and carriers to act with “reasonable diligence, care and skill” in making recommendations.

Topics: Standard of Care & Consumer Protection Interstate Advocacy Annuity Best Interest Insurance & Financial Advisor Regulation NAIC

2 min read

NAIFA-LA Secures Financial Professional Exemption in State Independent Contractor Law

By Julie Harrison on 6/22/21 8:56 AM

Louisiana Gov. John Bel Edwards recently signed a NAIFA-supported misclassification of workers bill into law. The bill, SB 244, outlines a 12-point definition for “independent contractor” developed by the Louisiana Association of Business and Industry which classifies an independent contractor as anyone who can meet seven of the 12 points. According to the new law, independent contractors could include workers who can’t set their hours, are not allowed to work for other businesses, and are directly managed or supervised by the contracting party.

Topics: State Advocacy Insurance & Financial Advisor Regulation Louisiana Producer Employment

4 min read

NAIFA State Advocacy Roundup

By Julie Harrison on 5/24/21 4:17 PM

NAIFA's state-level advocacy work is second-to-none, with state chapters and members providing expertise and influence to shape legislation and regulations impacting NAIFA members' businesses and clients across the country.

Topics: Long-Term Care Group & Employee Benefits State Advocacy Standard of Care & Consumer Protection Annuity Best Interest Insurance & Financial Advisor Regulation Paid Family Medical Leave

2 min read

Idaho Enacts Enhanced Protections for Annuity Consumers

By Julie Harrison on 3/17/21 2:15 PM

Idaho Governor Brad Little has signed a NAIFA-promoted best interest bill into law. The bill, HR 79, is based on the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transaction Model Regulation.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Idaho Insurance & Financial Advisor Regulation

1 min read

NAIFA-MT Promotes Favorable Auto Insurance Ratemaking Bill

By Julie Harrison on 3/17/21 1:58 PM

The Montana State Legislature is considering a bill that would end the state’s practice of treating all people, regardless of gender, the same by insurance companies when setting rates and product offerings.

Topics: State Advocacy Grassroots Montana Underwriting & Risk Classification

1 min read

NAIFA-MN Testifies Against Problematic Paid Family Medical Leave Bill

By Julie Harrison on 3/15/21 2:45 PM

NAIFA-MN opposes a bill that would create a state-wide paid and family medical leave insurance program in Minnesota, HF 1200, which is under consideration in the state House.

Topics: State Advocacy Grassroots Minnesota Paid Family Medical Leave

1 min read

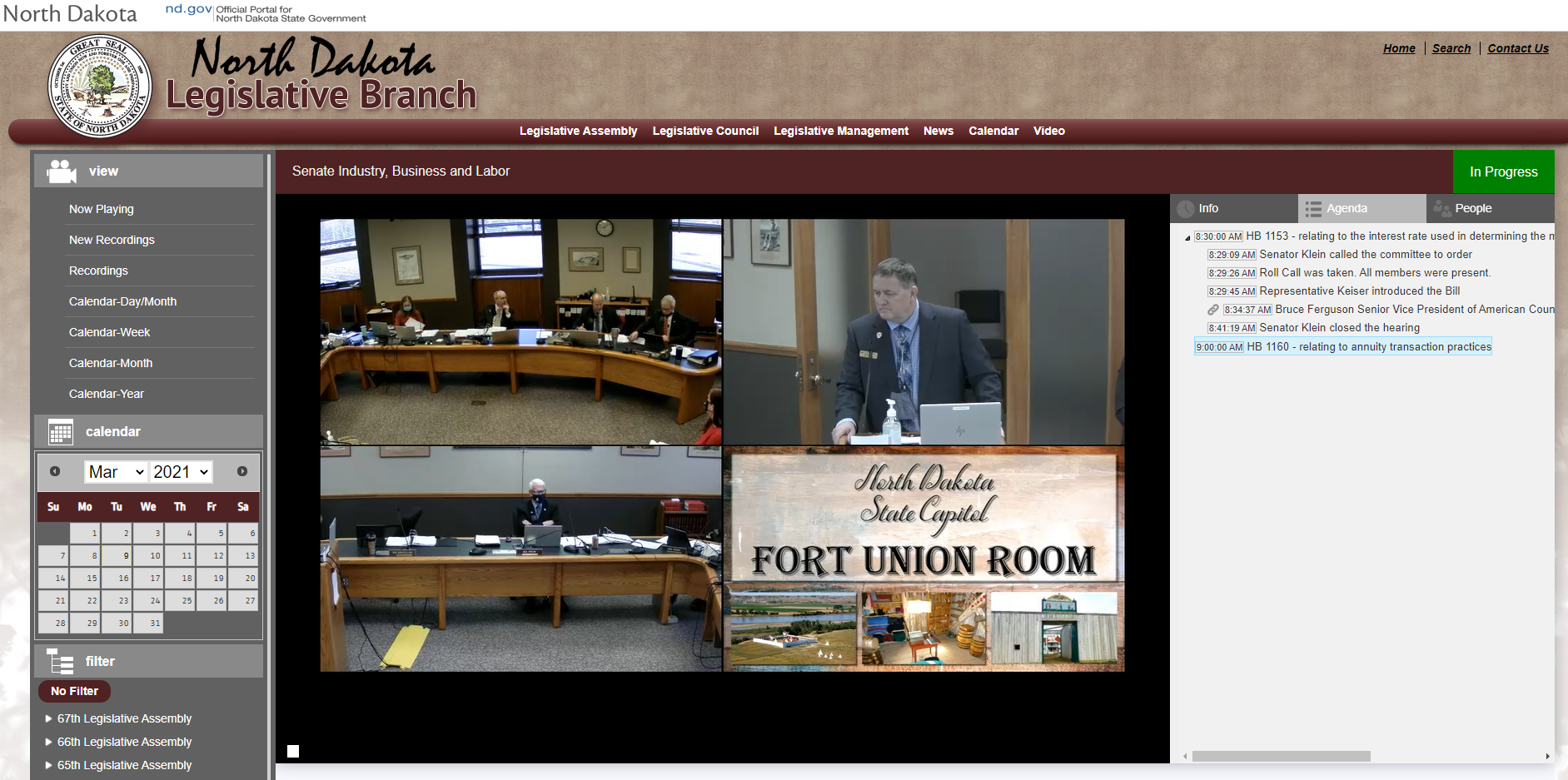

NAIFA-ND Tells Lawmakers Their Clients Come First

By Julie Harrison on 3/9/21 3:35 PM

NAIFA-ND President Lyle Kraft testified at the State Senate Industry, Business and Labor Committee on March 9, on the importance of passing an important new best interest standard.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest North Dakota Insurance & Financial Advisor Regulation

1 min read

NAIFA-TN Urges End of Professional Tax on Advisors and Broker-Dealers

By Julie Harrison on 3/2/21 3:55 PM

NAIFA-TN is using its advocacy muscle to convince state legislators to eradicate its professional privilege tax. The tax was used to balance budgets in 1992 and in 2002 and Tennessee is one of only six states with such a tax. Until two years ago, the tax applied to 22 different professions, including dentists, physicians, and real estate principal brokers. In 2019, Tennessee removed the discriminatory tax on 15 of the professions yet continues to require attorneys, securities agents, broker-dealers, investment advisers, lobbyists, osteopathic physicians, and physicians to pay the annual $400 tax.

Topics: State Advocacy Grassroots Producer Licensing & CE Tennessee

1 min read

NAIFA-WI Objects to Proposed Layers of Data Privacy Regulations

By Julie Harrison on 3/1/21 2:42 PM

NAIFA-WI joined other trade associations representing the insurance and financial services industry to push back on a potential regulatory proposal that would complicate existing data privacy and security laws.