Tuesday, March 23, at 11 am eastern

1 min read

NAIFA Advocacy Briefing: The Latest on the PRO Act

By NAIFA on 3/21/21 5:03 PM

Topics: Federal Advocacy PRO Act Congress Insurance & Financial Advisor Regulation Producer Employment

1 min read

NAIFA's Hedge Explains Potential Impacts of the PRO Act

By NAIFA on 3/18/21 8:45 AM

NAIFA Director of Government Relations Mike Hedge recently spoke with David Duford of Duford Insurance Group about the potential implications of the PRO Act for insurance and financial professionals. Hedge discusses how the PRO Act could disrupt the business relationships between producers and companies and harm the ability of agents and advisors to serve consumers. He also talks about the work NAIFA is doing to head off provisions of the PRO Act that would “revolutionize the industry for the wrong reasons.” The interview is featured on Duford’s popular YouTube channel.

Topics: Federal Advocacy PRO Act Congress Insurance & Financial Advisor Regulation Producer Employment

2 min read

Idaho Enacts Enhanced Protections for Annuity Consumers

By Julie Harrison on 3/17/21 2:15 PM

Idaho Governor Brad Little has signed a NAIFA-promoted best interest bill into law. The bill, HR 79, is based on the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transaction Model Regulation.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Idaho Insurance & Financial Advisor Regulation

1 min read

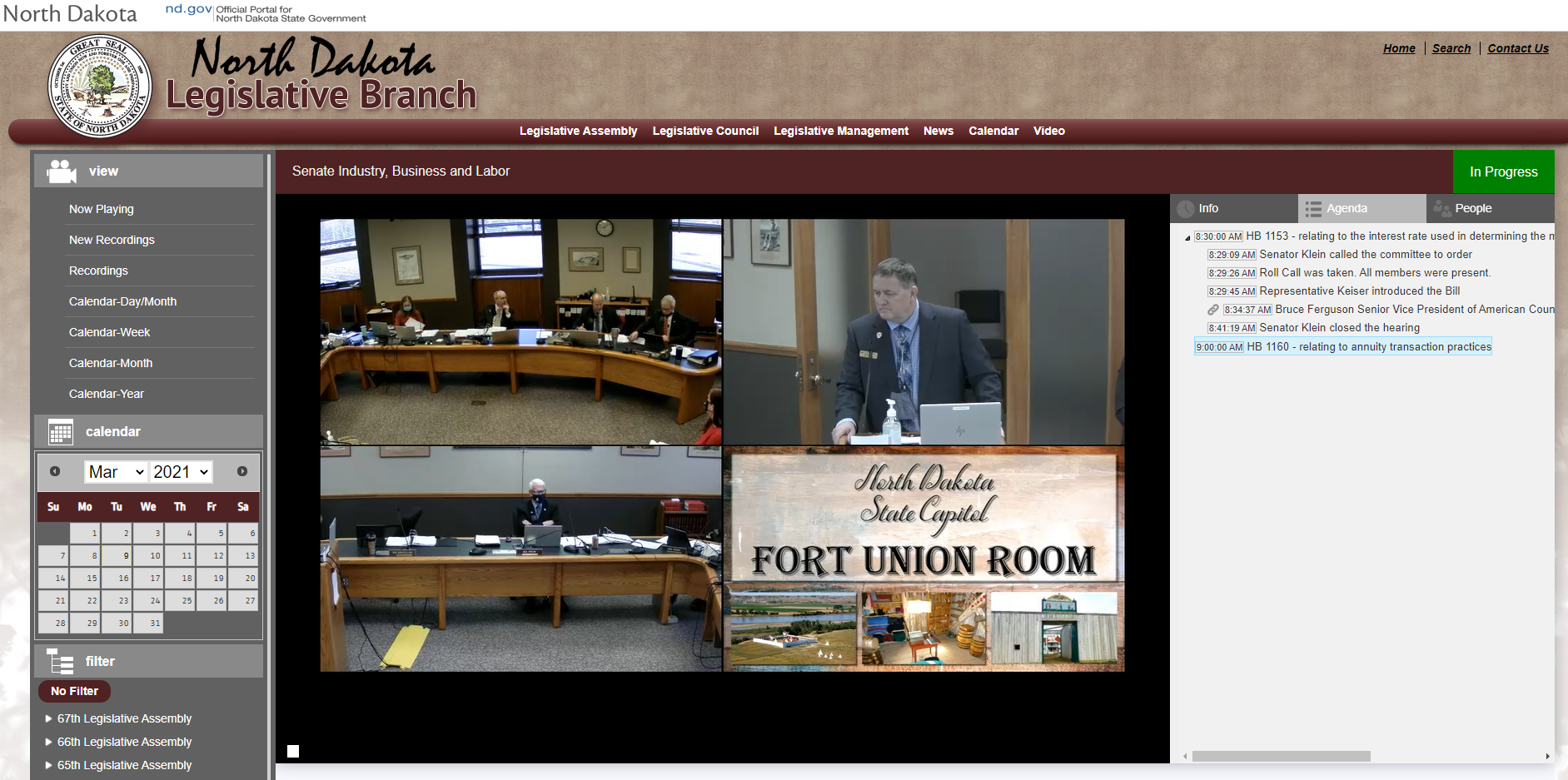

NAIFA-ND Tells Lawmakers Their Clients Come First

By Julie Harrison on 3/9/21 3:35 PM

NAIFA-ND President Lyle Kraft testified at the State Senate Industry, Business and Labor Committee on March 9, on the importance of passing an important new best interest standard.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest North Dakota Insurance & Financial Advisor Regulation

2 min read

As the House Passes the PRO Act, NAIFA Continues to Work for Changes

By NAIFA on 3/9/21 1:52 PM

The House of Representatives passed the Protecting the Right to Organize (PRO) Act (H.R. 842), a sweeping piece of labor legislation. Among its provisions, the PRO Act as passed by the House would reclassify many insurance and financial professionals as “employees” rather than “independent contractors” under federal labor law. NAIFA argues that such a reclassification will disrupt insurance and financial services business models and limit consumer access to diverse offerings of products, services, and advice.

Topics: Federal Advocacy PRO Act Congress Insurance & Financial Advisor Regulation Producer Employment

1 min read

NAIFA CEO Kevin Mayeux Signs Letter Seeking PRO Act Changes

By NAIFA on 3/4/21 4:12 PM

NAIFA CEO Kevin Mayeux and the CEOs of 13 other insurance and financial services trade associations sent a letter to House Speaker Nancy Pelosi and Minority Leader Kevin McCarthy urging Congress to address concerns with the Protecting the Right to Organize (PRO) Act (H.R. 842).

Topics: Federal Advocacy PRO Act Congress Insurance & Financial Advisor Regulation Producer Employment

1 min read

Worker Classification Under Scrutiny

By NAIFA Government Relations Team on 2/25/21 12:41 PM

The U.S. House of Representatives is currently considering introduction of the Protecting the Right to Organize Act (PRO Act) along mostly party lines, likely in April 2021. This wide-reaching bill seeks to reform current labor law in a variety of areas. Impacting the insurance industry, the bill amends the National Labor Relations Act (29 U.S.C. 152(3)) by adding language that expands the definition of “independent contractor” by adopting an “ABC” test to define who is an “employee.”

Topics: Federal Advocacy Congress Insurance & Financial Advisor Regulation Producer Employment

1 min read

DOL Confirms PTE on Retirement Advice Will Go Into Effect Feb. 15

By NAIFA on 2/12/21 4:50 PM

The Biden Administration has confirmed that the Department of Labor (DOL) will move forward with a prohibited transaction exemption (PTE) for financial professionals who provide retirement plan advice. DOL previously announced the new PTE on December 15 during the Trump Administration. It goes into effect February 15.

Topics: Standard of Care & Consumer Protection Federal Advocacy DOL Insurance & Financial Advisor Regulation

1 min read

NAIFA-Idaho Testifies at Hearing on Annuity Best Interest Legislation

By NAIFA on 2/11/21 6:14 PM

NAIFA-Idaho member EmmaLee Robinson testified before a hearing of the Idaho Legislature on the Annuity Consumer Protections Act (HB 79) and encouraged lawmakers to adopt legislation based on the National Association of Insurance Commissioners’ updated Suitability in Annuity Transactions Model. The NAIC model requires financial professionals to work in the best interests of consumers on annuity transactions.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Idaho Insurance & Financial Advisor Regulation

1 min read

Ohio Finalizes Annuities Best Interest Rule Based on the NAIC Model

By NAIFA on 2/10/21 5:05 PM

The Ohio Department of Insurance has finalized a rule based on the National Association of Insurance Commissioners’ updated Suitability in Annuity Transactions Model that requires financial professionals to work in the best interests of consumers on annuity transactions. The new rule goes into effect in Ohio on Feb. 14.