A new survey by the Alliance for Lifetime Income (ALI) finds that 70% of older working Americans with at least $100,000 in assets are more pessimistic about their retirement plans because of the COVID-19 pandemic. One-in-five of these workers, or approximately 3.2 million Americans, now plans to retire later than they had anticipated. ALI notes that the number would likely be much higher had the survey also included older workers with less than $100,000 in assets.

1 min read

ALI Survey Finds Growing Concern Among Workers Planning for Retirement

By NAIFA on 7/29/20 1:26 PM

Topics: Retirement Planning Federal Advocacy Advocacy Resources

1 min read

IRS Provides Flexibility on RMD Rollovers for 2020

By NAIFA on 7/24/20 4:43 PM

The CARES Act, signed into law in late March, waives the 2020 required minimum distribution (RMD) for IRAs and defined contribution plans, like 401(k)s and 403(b)s. This provides owners of these products flexibility and prevents them from having to draw down their plans while facing COVID-19-related market volatility.

Topics: Retirement Planning Federal Advocacy IRS

1 min read

SEC Chair Urges Caution Recommending Retirement Account Rollovers, Withdrawals

By NAIFA on 6/18/20 9:07 AM

SEC Chairman Jay Clayton issued a statement June 15 reminding financial firms and advisors of the new, enhanced conduct standards found in Regulation Best Interest. Reg BI requires broker-dealers and their representatives to act in the best interest of their clients when making recommendations, and to not put the firm’s or representatives’s financial interests ahead of the consumer’s.

Topics: Retirement Planning SEC Federal Advocacy

1 min read

NAIFA Urges Congress to Bolster Retirement Savers in Next Phase of COVID-19 Legislation

By NAIFA on 6/17/20 2:45 PM

NAIFA’s advocacy team and grassroots army have been engaged from the beginning of conronavirus-related shutdowns with Congress, state legislatures, and federal and state regulators on proposals to provide economic relief and recovery assistance to individuals, families, and small businesses. We provided input to Congress as they shaped the first three phases of COVID-19 legislation, including the Paycheck Protection Program.

Topics: Retirement Planning Federal Advocacy Congress

1 min read

NAIFA Sees Small Victory in Colorado Secure Choice Plan

By NAIFA on 6/10/20 5:48 PM

Colorado’s Implementation of Colorado Secure Savings Program bill, SB 200, is on a trajectory to pass. NAIFA, along with the American Council of Life Insurers, Insured Retirement Institute, and National Federation of Independent Business, worked diligently to counter the measure. There was limited time for debate. Also, the proposal is an initiative of the House Speaker. These factors make it all but impossible to defeat.

Topics: Retirement Planning State-Facilitated Retirement Plans State Advocacy Colorado

2 min read

NAIFA Advocates Health, Retirement, and Life Insurance Proposals for Next Round of COVID-19 Legislation

By NAIFA on 4/24/20 4:01 PM

The latest federal COVID-19 relief package, signed into law today, provides $484 billion in funding, including $310 billion for the Paycheck Protection Program, $50 billion for Economic Injury Disaster Loans, $75 billion for hospitals, and $25 billion for expanded COVID-19 testing.

Topics: Retirement Planning COVID-19 Federal Advocacy Congress

State Securities Regulators Up and Running

By NAIFA on 3/24/20 8:56 AM

State securities regulators have taken responsible safety measures in light of the Coronavirus, but are providing necessary services for their registrants and consumers. Recognizing the disruptions and dislocations caused by the COVID--19 outbreak, many state securities departments are making appropriate accommodations and are providing helpful relief from regular registration, filing, and other requirements for registrants who meet certain criteria.

Topics: Retirement Planning State Advocacy

1 min read

NAIFA Member to the Seattle Times: State-Run Retirement Plan Is a Bad Idea

By NAIFA on 2/25/20 11:06 AM

Legislation now before the Washington Legislature in Olympia that would create a state-run retirement plan “misses the mark,” writes Ryan Jewell, a member of the Board of Trustees with NAIFA’s Washington Chapter, in a letter to the editors of the Seattle Times.

Topics: Retirement Planning State-Facilitated Retirement Plans State Advocacy Washington

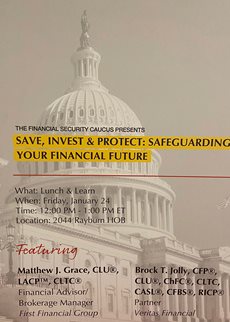

NAIFA Leaders Present Educational Session For Congressional Financial Security Caucus

By NAIFA on 1/24/20 10:21 AM

NAIFA Treasurer Brock Jolly and NAIFA-Greater Washington Advocacy Chair Matthew Grace are featured speakers at a lunch and learn to members of Congress and staff entitled: “Save, Invest & Protect: Safeguarding Your Financial Future.”

Topics: Retirement Planning Member Spotlight Congress

1 min read

Maine Proposal Would Create State-Run Retirement Plan

By NAIFA on 1/15/20 2:39 PM

Maine’s legislature is reconsidering a bill from its 2019 session that would create a state-run retirement plan to compete with existing private-sector solutions. NAIFA believes that state-run plans, like the one proposed for Maine, fail to understand why many Americans are not saving enough for retirement.