Legislation signed into law today by Nebraska Governor Pete Ricketts provides citizens throughout the Cornhusker state with enhanced consumer protections when buying annuities. Strongly supported by Nebraska Director of Insurance Bruce Ramge and championed in the Nebraska Legislature by State Senator Matt Williams, the new law closely tracks the ‘best interest of consumer enhancements’ in the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transactions Model Regulation. It also aligns with the SEC’s Regulation Best Interest.

2 min read

Nebraska Law Enhances Protections for Annuity Consumers

By NAIFA on 4/8/21 11:23 AM

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Insurance & Financial Advisor Regulation Nebraska

1 min read

NAIFA-CA's Virtual Day on the Hill Is a Success

By NAIFA on 4/6/21 9:00 AM

NAIFA-California held their annual Day on the Hill as a virtual event over several days in late March. Attendees received legislative and regulatory updates and heard from speakers who shared insights about building relationships with lawmakers and being an effective political advocate.

Topics: State Advocacy Grassroots California Legislative Day

1 min read

NAIFA-Iowa Holds Day on the Hill

By NAIFA on 3/27/21 4:42 PM

State advocacy is among part of NAIFA's critical mission to ensure policymakers in every state capital understand the important role of insurance and financial professionals in providing financial security and prosperity to families and small business in communities across the United States.

Topics: State Advocacy Grassroots Iowa Legislative Day

2 min read

Legendary Consumer Protection

By Bruce Ferguson and Lyle Kraft on 3/26/21 3:14 PM

In 2018, North Dakota Governor Doug Burgum unveiled the state’s new brand: Be Legendary.

Topics: State Advocacy Standard of Care & Consumer Protection Annuity Best Interest North Dakota Insurance & Financial Advisor Regulation

2 min read

Idaho Enacts Enhanced Protections for Annuity Consumers

By Julie Harrison on 3/17/21 2:15 PM

Idaho Governor Brad Little has signed a NAIFA-promoted best interest bill into law. The bill, HR 79, is based on the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transaction Model Regulation.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest Idaho Insurance & Financial Advisor Regulation

1 min read

NAIFA-MT Promotes Favorable Auto Insurance Ratemaking Bill

By Julie Harrison on 3/17/21 1:58 PM

The Montana State Legislature is considering a bill that would end the state’s practice of treating all people, regardless of gender, the same by insurance companies when setting rates and product offerings.

Topics: State Advocacy Grassroots Montana Underwriting & Risk Classification

1 min read

NAIFA-MN Testifies Against Problematic Paid Family Medical Leave Bill

By Julie Harrison on 3/15/21 2:45 PM

NAIFA-MN opposes a bill that would create a state-wide paid and family medical leave insurance program in Minnesota, HF 1200, which is under consideration in the state House.

Topics: State Advocacy Grassroots Minnesota Paid Family Medical Leave

1 min read

NAIFA-ME Connects Producers and Lawmakers at Virtual Legislative Breakfast

By NAIFA on 3/12/21 9:12 AM

NAIFA-Maine’s virtual Legislative Breakfast on March 9 featured video conference meetings connecting NAIFA members with state lawmakers whose policy decision impact the businesses of insurance and financial professionals as well as the consumers they serve. Legislators in attendance included:

Topics: State Advocacy Grassroots Legislative Day Maine

1 min read

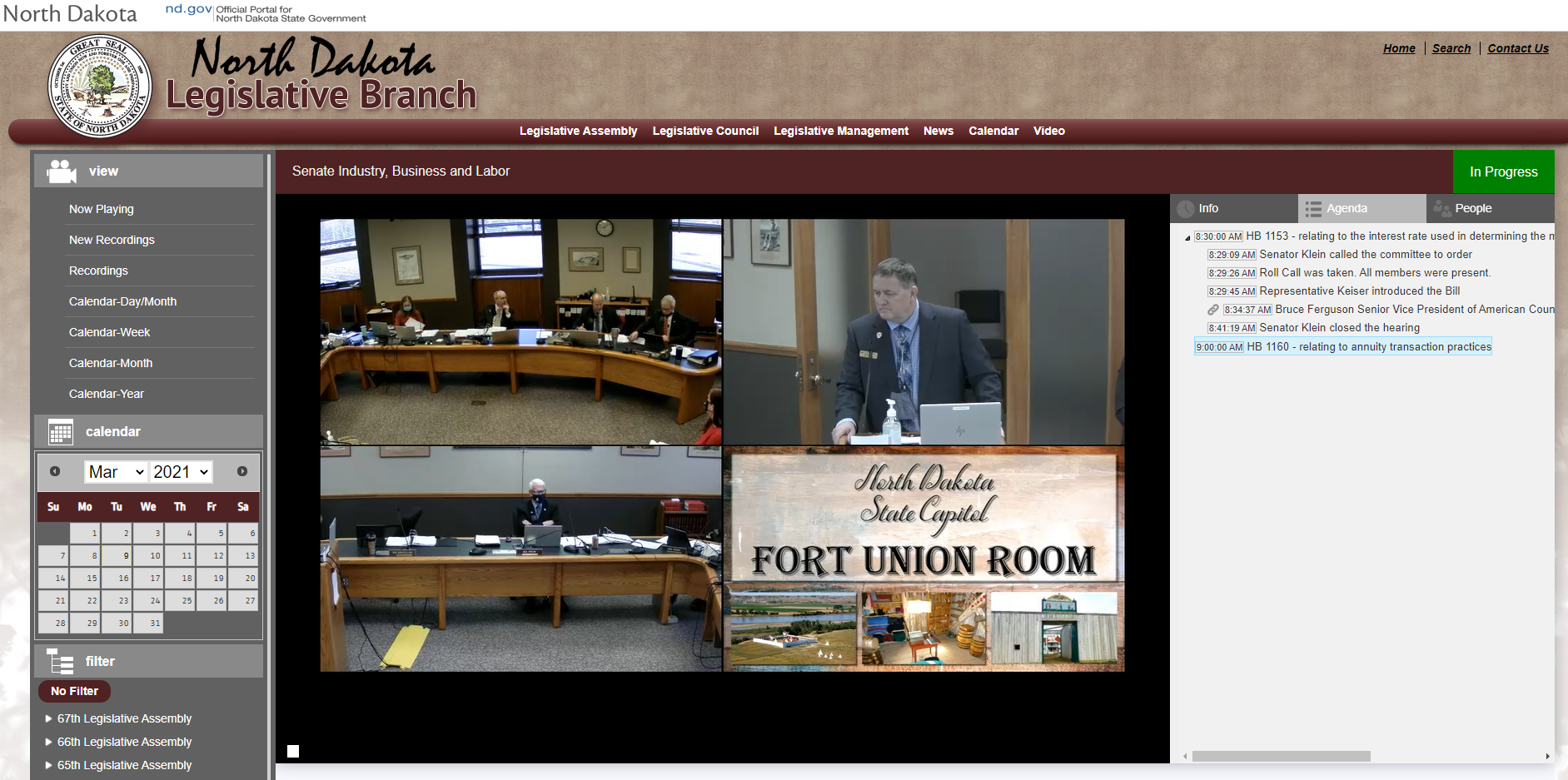

NAIFA-ND Tells Lawmakers Their Clients Come First

By Julie Harrison on 3/9/21 3:35 PM

NAIFA-ND President Lyle Kraft testified at the State Senate Industry, Business and Labor Committee on March 9, on the importance of passing an important new best interest standard.

Topics: State Advocacy Standard of Care & Consumer Protection Grassroots Annuity Best Interest North Dakota Insurance & Financial Advisor Regulation

1 min read

NAIFA-TX Holds Successful Virtual Day at the Capitol Advocacy Event

By NAIFA on 3/3/21 5:02 PM

NAIFA’s Texas chapter (NAIFA-TX) held a successful legislative event last week, with several dozen participants. The annual Day at the Capitol was planned as a hybrid event, with both in-person and virtual attendees. However, the lingering effects of recent winter storms required NAIFA-TX to quickly shift to an all-virtual event.