NAIFA's "State of Advocacy" report details NAIFA's federal, state, and interstate advocacy efforts in 2022 in facts and figures. It also runs down the major policy issues impacting agents and advisors as well as the Main Street consumers they serve.

NAIFA's "State of Advocacy" provides a snapshot of how NAIFA and NAIFA members are making a difference and influencing the decisions that affect Americans' financial security.

1 min read

The State of Advocacy Report Tells the Story of NAIFA's Political Influence

By NAIFA on 2/16/23 4:59 PM

Topics: State Advocacy Interstate Advocacy Federal Advocacy

1 min read

NAIFA-CO Meets With Lawmakers in Denver to Advocate for Main Street USA

By NAIFA on 2/16/23 10:02 AM

NAIFA-CO leaders and members came together February 15 to meet with lawmakers on the chapter's annual Legislative Day. Members shared their insights with legislators and officials, including Securities Commissioner Tung Chan and Insurance Commissioner Michael Conway. Central among the topics discussed was HB23-1174, which would create guaranteed replacement cost coverage in homeowner's insurance, and its implications for Coloradoans.

Topics: Advocacy Legislation & Regulations State Advocacy Legislative Day

2 min read

I Love NAIFA Month: Show Your Love for NAIFA Advocacy

By NAIFA on 2/12/23 9:15 AM

There are many reasons to love NAIFA’s advocacy work – how about protecting your business and clients from harmful legislative and regulatory proposals, for starters? And there are just as many ways to get involved and make a difference.

Topics: State Advocacy Federal Advocacy

2 min read

New Rule Strengthens Protections for Annuity Consumers in Tennessee

By NAIFA & ACLI on 1/27/23 10:33 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-TN President Scott Flowers issued the following joint statement on the best interest annuity rule adopted recently by the Tennessee Department of Commerce and Insurance:

“The new rule adopted by Director Carter Lawrence and the Tennessee Department of Commerce and Insurance advances important consumer safeguards and adds to the nationwide push for enhanced protections for annuity consumers.

“Tennessee becomes the 31st state to adopt the ‘best interest of consumer enhancements’ in the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transactions Model Regulation. These new laws and regulations also harmonize with the SEC’s Regulation Best Interest. They enhance the standards financial professionals must follow while safeguarding retirement savers’ access to, and information about, annuities, the only financial product in the marketplace that can provide guaranteed income for life.

“Unlike a fiduciary-only approach, these measures ensure that all savers, particularly financially vulnerable middle-income Americans, can get information about different choices for long-term security in retirement. A recent survey finds that middle-income retirement savers would be very concerned about a regulation keeping them from accessing the professional financial guidance they want and need.

“The U.S. Congress reaffirmed the importance of lifetime income when it passed legislation in 2019 and 2022 that made it easier for employers to include annuities in workplace retirement plans. These protections safeguard consumers while also ensuring that middle- and working-class families will retain access to easy-to-understand financial information.

“We hope that other states will follow Tennessee and implement these sensible protections so that more consumers can benefit from a best interest standard of care, no matter where they live.”

Topics: State Advocacy Standard of Care & Consumer Protection Interstate Advocacy Press Release Annuity Best Interest Tennessee

1 min read

Advocacy Ambassadors Bolster NAIFA's Grassroots Influence

By NAIFA on 1/24/23 5:13 PM

Participation by NAIFA members is key to our grassroots advocacy strength. Learn how you can make a difference by signing up to be a NAIFA Advocacy Ambassador. Be a legislative contact, write a letter to the editor or op-ed, testify at a public hearing, visit with your lawmaker, or host an event. Find out all of the ways you can get involved.

Topics: State Advocacy Federal Advocacy Grassroots

2 min read

Massachusetts Strengthens Protections for Annuity Consumers

By NAIFA & ACLI on 12/13/22 3:54 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-MA President Josh O’Gara issued the following joint statement on the best interest annuity rule adopted recently by the Massachusetts Division of Insurance:

“The new rule adopted by the Massachusetts Division of Insurance adds to the nationwide drive for enhanced protections for consumers seeking lifetime income through annuities.

Topics: State Advocacy Press Release Annuity Best Interest

2 min read

State Senate Hearing on LTC Features Testimony of NAIFA-WA's Chris Bor

By NAIFA on 12/8/22 5:42 PM

Chris Bor, LUTCF, CLU, ChFC, a loyal NAIFA member since 1998 and Immediate Past President of NAIFA-WA, testified at a hearing of the Washington State Senate Business, Financial Services & Trade Committee on the use of life insurance, annuities, and policy riders in long-term care planning. He gave an overview of a wide variety of LTC planning options and discussed the value of agents and advisors to consumers. Bor also serves as Vice-Chair of NAIFA's National Membership Committee.

Topics: Long-Term Care Life Insurance & Annuities State Advocacy Washington

1 min read

NAIFA New Mexico Advocates for Access to Financial Literacy

By Bianca Alonso Weiss on 12/5/22 4:33 PM

Last week, NAIFA-New Mexico testified before the Senate Economic Development and Policy Committee in support of having financial literacy be a graduation requirement for New Mexico public high schools. NAIFA-New Mexico President, Chad Cooper, who also serves as the Vice Chairman of the African American Greater Albuquerque Chamber of Commerce and serves his clients as a financial advisor for Gateway Financial Advisors, Inc. and Mike McCaffrey, Vice President of Advocacy for NAIFA-New Mexico and agent with New York Life, provided oral comments to the committee.

Topics: State Advocacy Financial Literacy New Mexico

2 min read

Alaska Adopts Stronger Safeguards for Annuity Consumers

By American Council of Life Insurers on 10/31/22 11:01 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA)-Alaska Vice President of Advocacy, Lanet Spence, issued the following joint statement on the best interest annuity rule adopted recently by the Alaska Division of Insurance:

Topics: State Advocacy Standard of Care & Consumer Protection Insurance & Financial Advisor Regulation

3 min read

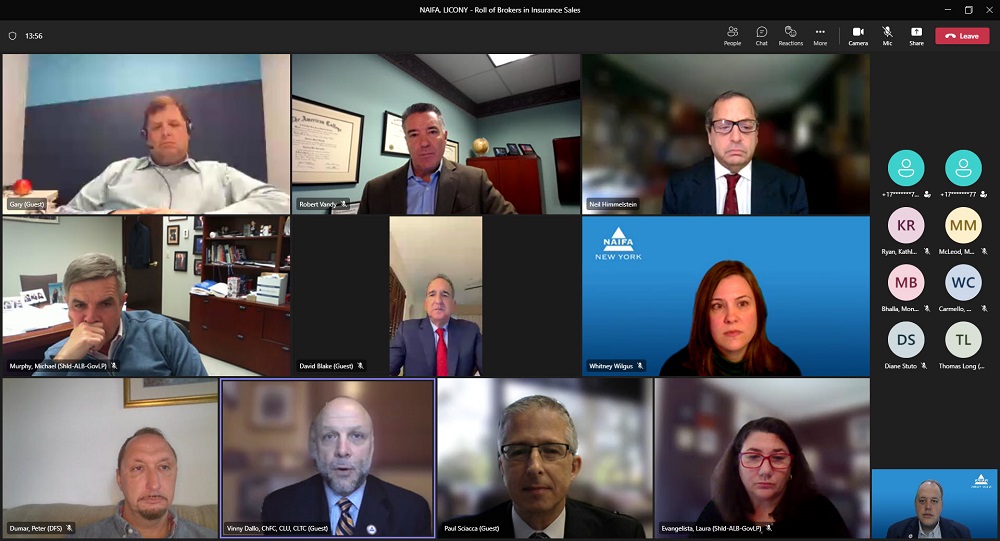

NAIFA-NY Members Meet With DFS Officials to Address Challenges Serving Clients in the State

By NAIFA on 10/20/22 2:06 PM

Members of NAIFA’s New York chapter (NAIFA-NY) held a virtual meeting with officials from the state Department of Financial Services (DFS). State President Gary Cappon, CLU, LUTCF, RICP, FSCP, CLTC, provided introductions and a brief rundown of NAIFA’s advocacy work and support for the agent and advisor community and the consumers they serve. He also discussed challenges with financial product availability in the state. President-Elect Vinny Dallo, ChFC, CLU, CLTC, LUTCF, and Vice President of Advocacy Paul Sciacca presented “A Day in the Life of a Financial Professional,” highlighting how NAIFA members serve families and businesses in the state.