The Massachusetts Division of Insurance announced earlier this year that the state insurance licensing exam will now be offered in Spanish. NAIFA's Massachusetts chapter has been working with the Division of Insurance on this initiative and advocated for its adoption.

2 min read

State Adopts NAIFA-MA Proposal to Offer Insurance Licensing Exams in Spanish

By NAIFA on 9/19/22 11:21 AM

Topics: State Advocacy Press Release Licensing

1 min read

Quick Action Leads to NAIFA-MA Advocacy Win

By NAIFA on 8/11/22 10:03 AM

NAIFA-MA is celebrating a major advocacy win after a very close call. During the last three days of the legislative session which concluded July 31, the General Court introduced H. 5123 which would have implemented a two-year pilot program to extend eligibility for premium assistance payments on point of service cost-sharing subsidies for certain health insurance applicants. In short, this legislation would have implemented a pilot single-payer health coverage program, thus having a catastrophic impact on employer-sponsored health plans.

Topics: Health Care State Advocacy Massachusetts

2 min read

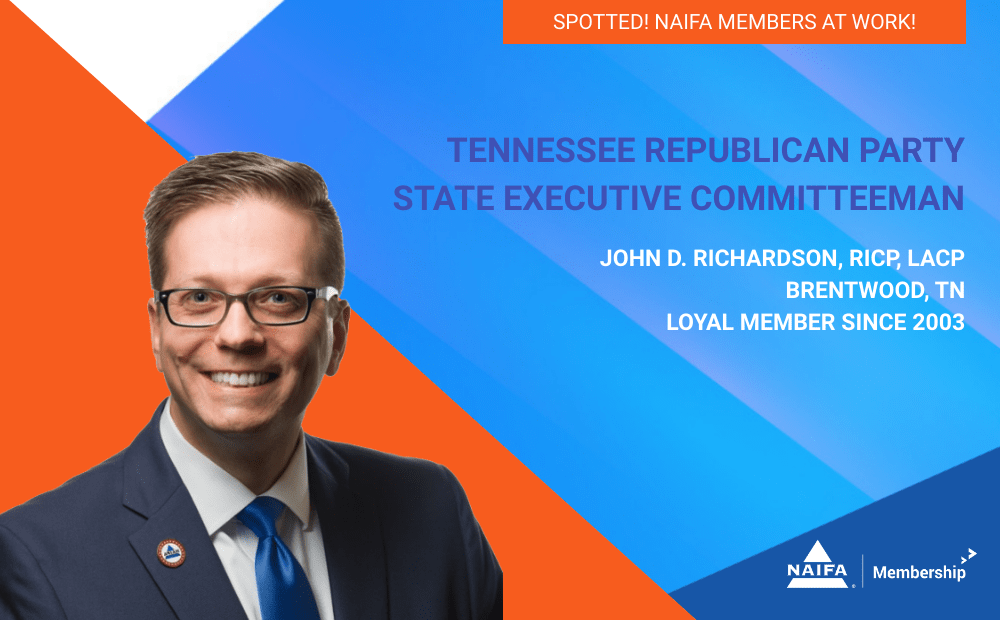

NAIFA-TN's John D. Richardson Elected to State Executive Committee

By NAIFA on 8/10/22 5:21 PM

John D. Richardson, RICP, LACP, loyal NAIFA member since 2003, was recently elected to serve on the Tennessee Republican Party State Executive Committee for Senate District 21.

Richardson's leadership and professional success have been noteworthy throughout his tenure as a NAIFA member. After graduating from the University of Tennessee-Knoxville with a B.A. in Political Science and a Minor in Spanish, he began his career as an advisor in 2005. Today he is a Financial Planner and Partner with Boundbrook Advisors (MassMutual), a firm he co-founded in Brentwood, TN.

Topics: State Advocacy Member Spotlight Tennessee

2 min read

Colorado Adopts Stronger Protections for Annuity Consumers

By NAIFA & ACLI on 8/5/22 1:33 PM

ACLI President and CEO Susan Neely and NAIFA-CO Political Action Committee Chair and Government Relations Committee member Brent Jones issued the following joint statement on the best interest annuity rule adopted recently by the Colorado Division of Insurance:

Topics: State Advocacy Standard of Care & Consumer Protection Colorado Annuity Best Interest

2 min read

Advocacy Rewind: Spotlight on NAIFA-Nebraska

By Bianca Alonso Weiss on 7/25/22 5:41 PM

On March 1, 2022, NAIFA-Nebraska hosted their successful Legislative Day event in Lincoln. NAIFA-NE members in attendance received briefings from:

Topics: State Advocacy Grassroots Nebraska

Get Out the Vote Resources Now Available

By NAIFA on 7/18/22 10:00 AM

Whether you're new to political advocacy or a grassroots leader, NAIFA's Get Out the Vote is a great resource for everything you need to know about NAIFA's political advocacy. Find information on polling dates and locations, ballot measures, and your elected officials. Brush up on Government 101 or find the text of individual bills—this site has useful information for everyone.

Topics: State Advocacy Federal Advocacy Grassroots

3 min read

NAIFA Expands its Diversity, Equity, and Inclusion Efforts through New Outreach to Financial Services Professionals and Prospective Professionals

By NAIFA on 7/15/22 7:47 AM

NAIFA Invites Women and Hispanic Agents and Advisors to Two New Programs in August

The National Association of Insurance and Financial Advisors (NAIFA) has announced the addition of two programs that will run on Tuesday, August 16th pre-conference to its upcoming Apex event being held in Phoenix, Arizona. The sessions focus on raising awareness for state, interstate, and federal advocacy and stress the importance of financial advisors to get involved, starting with voting, in the political process.

Topics: Diversity State Advocacy Federal Advocacy

2 min read

New Law in Hawaii Strengthens Protections for Annuity Consumers

By NAIFA Government Relations Team on 6/23/22 8:43 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA) Hawaii Government Relations Chair Cynthia Takenaka issued the following joint statement on legislation signed into law in Hawaii that strengthens protections for annuity consumers:

Topics: State Advocacy Standard of Care & Consumer Protection Annuity Best Interest Hawaii

1 min read

Michigan Passes High School Financial Literacy Education Requirement

By NAIFA on 6/21/22 10:49 AM

NAIFA is proud that Michigan is the 14th state to embrace a personal finance education course requirement. Michigan's legislation requires that all high school students take a half-credit course in personal finance before they graduate. The Michigan House of Representatives passed HB 5190 by a vote of 94-13 and the bill passed the state's Senate in May with a vote of 35-2. Members of NAIFA-Michigan, who first created this concept a decade ago with legislation to create optional courses, celebrate the signature of Governor Whitmer updating Michigan’s high school curriculum to include a financial literacy course.

Topics: State Advocacy Financial Literacy Michigan

1 min read

North Carolina Enhances Protections for Annuity Consumers

By NAIFA & ACLI on 6/14/22 2:38 PM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA) North Carolina Government Relations Committee Chair Fred Joyner issued the following joint statement on the best interest annuity rule adopted recently by the North Carolina Department of Insurance:

“The new rule adopted by the North Carolina Department of Insurance and under the leadership of Commissioner Mike Causey gives people in the Tar Heel State confidence that the financial professionals they are working with are acting in consumers’ best interest.

“The department’s action adds to the nationwide, bipartisan momentum behind enhanced protections for people seeking lifetime income in retirement through annuities. North Carolina is the 26th state to adopt a measure that aligns with the ‘best interest of consumer enhancements’ in the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transactions Model Regulation. They also harmonize with the SEC’s Regulation Best Interest.

“Unlike a fiduciary-only approach, these measures ensure that all savers, particularly financially vulnerable middle-income Americans, can access information about different choices for long-term security throughout retirement. A new survey finds that middle-income retirement savers would be very concerned about a regulation keeping them from accessing the professional financial guidance they want and need.

“The U.S. Congress reaffirmed the importance of lifetime income when it passed legislation in 2019 that made it easier for employers to include annuities in workplace retirement plans. These protections safeguard consumers while also ensuring that middle- and working-class families retain access to annuities.

“We look forward to seeing additional states add to this momentum for enhanced protections so that more consumers can benefit from a best interest standard of care.”