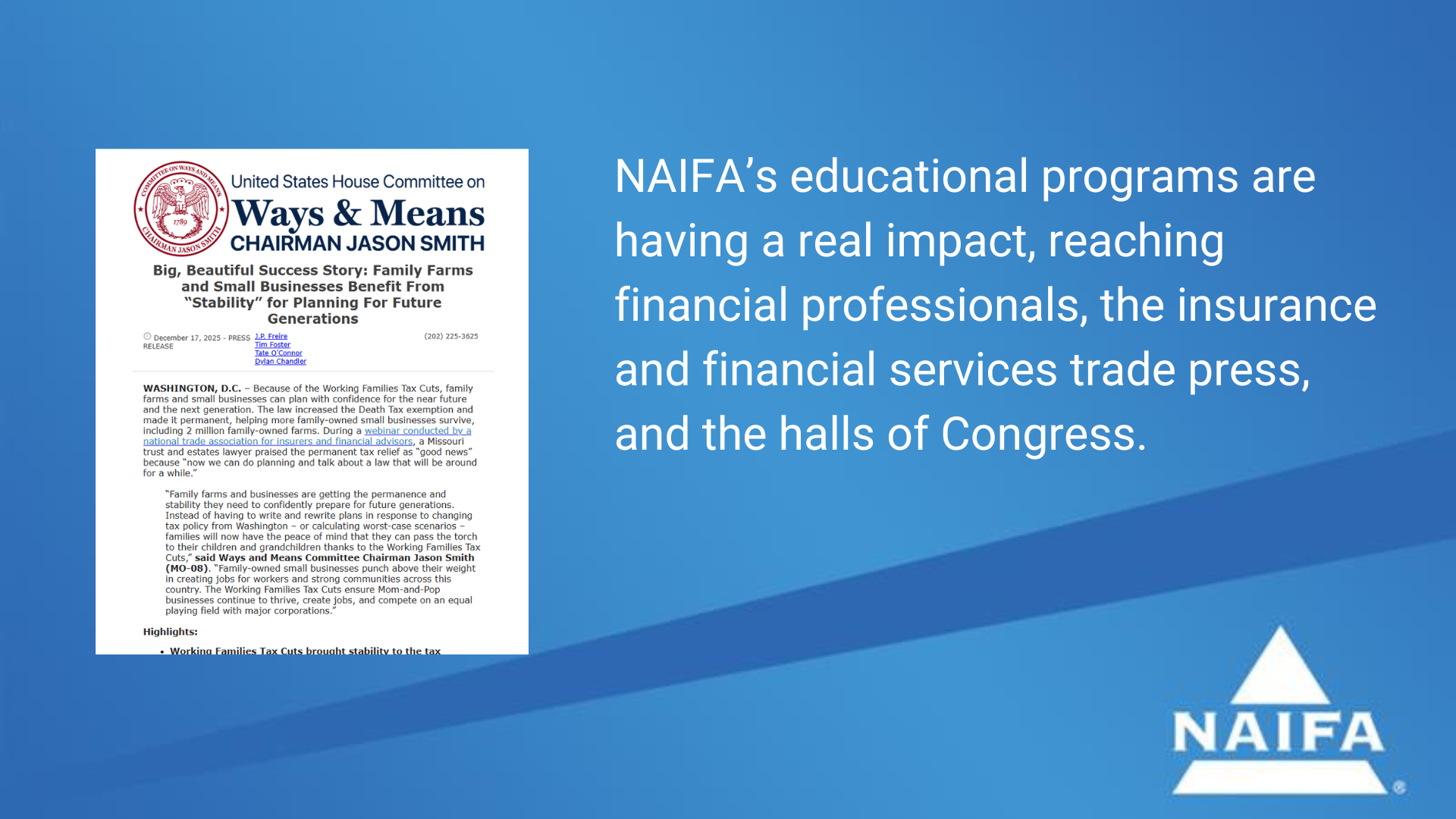

The House Ways & Means Committee issued a press release on tax reform measures for small businesses that highlights the recent NAIFA webinar, “The One Big Beautiful Bill: Several Big Beautiful(?) Tax Law Changes,” featuring Robert Kirkland, founding member of Kirkland Hochstetler law firm. The tax and spending bill known as the One Big Beautiful Bill (OBBB)” passed earlier this year stabilizes estate tax laws making legacy planning less challenging, Kirkland explained. InsuranceNewsNet magazine’s Advisor News also reported on the NAIFA webinar.

1 min read

Ways & Means Spotlights NAIFA Webinar in Tax Law Press Release

By NAIFA on 12/19/25 9:45 AM

Topics: Estate Planning Webinar Press Release Congress Tax Reform

1 min read

Master HR1 for Client Conversations

By NAIFA on 7/11/25 3:57 PM

The recently enacted HR 1 brings significant changes to tax policy, retirement planning, and financial strategies that clients rely on. As financial professionals, it’s essential to stay ahead of the curve - not just to understand the updates, but to explain them in ways that build trust and reinforce our value.

Join NAIFA for a timely and practical webinar designed to help you turn technical policy updates into meaningful client conversations.

Topics: Tax Reform

6 min read

What Financial Professionals Need to Know About the Final Reconciliation Bill

By NAIFA on 7/3/25 1:06 PM

The newly finalized reconciliation bill delivers a sweeping set of tax provisions that will shape how financial professionals advise clients - individuals, families, and businesses - for years to come. From income tax and charitable giving to estate planning and business deductions, this legislation locks in key provisions of the Tax Cuts and Jobs Act (TCJA) while adding new tools across multiple areas of financial planning. NAIFA has identified 15 key takeaways that every financial professional should know. Download PDF.

Topics: Press Release Tax Reform

1 min read

NAIFA-Supported Measures in the Senate Reconciliation Bill Favor Main Street Businesses

By NAIFA on 7/1/25 12:15 PM

NAIFA CEO Kevin Mayeux, CAE, issued the following statement upon Senate passage of its version of the tax and spending reconciliation bill:

“NAIFA is pleased that the Senate-passed reconciliation bill includes important measures that protect the financial security of American families and businesses. NAIFA members have strongly encouraged lawmakers to include permanent extensions of the 199A tax deduction for pass-through businesses and most of the individual tax rates and deductions that would have expired this year. We have also asked lawmakers to reject a cap on the corporate state and local tax (C-SALT) deduction and new taxes on insurers or insurance products. American consumers will benefit from the fact that the bill preserves the existing tax treatment of financial tools and imposes no new burdens that would prevent insurance and financial professionals from effectively serving the American public. NAIFA will continue to monitor the bill as it now returns to the House for final passage. Major changes that will impact our members or the financial security of the Main Street consumers they serve are unlikely.”

Topics: Legislation & Regulations Press Release Tax Reform

1 min read

NAIFA Supports Passage of Provisions in H.R. 1 that Support Main Street Businesses

By NAIFA on 6/29/25 11:05 AM

The National Association of Insurance and Financial Advisors (NAIFA) supports the budget reconciliation tax package and has signed onto two coalition letters (here and here) urging Congress to enact this important legislation. This tax package builds on the foundation laid by the Tax Cuts and Jobs Act and reflects a clear commitment to policies that enable Main Street businesses including insurance and financial professionals to thrive. It addresses long-standing tax concerns that impact the majority of small businesses and pass-through entities that form the backbone of local economies.

Topics: Tax Reform

1 min read

NAIFA Asks the Senate to Avoid a Tax Hike for Millions of Small Businesses

By Kevin Mayeux on 6/26/25 11:23 AM

The Senate is preparing revisions to the massive budget and tax bill previously approved by the House with a goal of passing final legislation by July 4th. It is crucial to millions of Main Street businesses, many of which are owned or served by NAIFA members, that the final reconciliation bill makes the Section 199A deduction for pass-through businesses permanent and expands the deduction from 20 to 23%.

Topics: Legislation & Regulations Press Release Tax Reform NAIFA CEO Executive Summary

1 min read

Lawmakers Introduce the Main Street Tax Certainty Act

By NAIFA on 1/24/25 4:21 PM

Senator Steve Daines (R-MT), Majority Leader John Thune (R-SD), and 33 Republican Senators have introduced the Main Street Tax Certainty Act, a bill that would make the 20% pass-through business tax deduction permanent. Representative Lloyd Smucker (R-PA) has introduced companion legislation in the House, which is co-sponsored by 153 Representatives. The deduction is currently set to expire with many provisions of the Tax Cuts and Jobs Act at the end of this year.

Topics: Federal Advocacy Supported Legislation Tax Reform

2 min read

Talking About Taxes With NAIFA SVP Diane Boyle

By Kevin Mayeux on 11/21/24 10:28 AM

I recently sat down with NAIFA Senior Vice President for Government Relations Diane Boyle to discuss the election and its implications for the upcoming tax reform debate in the 119th Congress.

Topics: Congress Tax Reform Message From the CEO NAIFA CEO Executive Summary

2 min read

The Super Bowl of Tax Reform: Are You Ready to Take on What’s Next?

By Diane Boyle on 10/25/24 3:44 PM

2025 is gearing up to be a high-stakes year for tax reform. For financial professionals, it’s a lot like preparing for the Super Bowl. The clock is ticking as Congress pushes toward major tax legislation, driven by the impending expiration of individual tax cuts from the 2017 Tax Cuts and Jobs Act (TCJA). Extending TCJA could add an estimated $4.5 trillion to the federal deficit over 10 years. With such a high price tag, lawmakers are on a relentless hunt for revenue, putting every corner of the financial landscape—including insurance and financial services—under intense scrutiny.

Topics: Tax Reform

2 min read

The NAIFA Advocacy Webinar, 'Tax Reform Priorities and Politics,' Is Available On Demand

By NAIFA on 6/14/24 4:44 PM

Major federal tax legislation is all but certain to be coming from Washington, D.C., in 2025. Many provisions from the 2017 Tax Cuts and Jobs Act (TCJA) are set to expire at the end of next year and Congress will need to address the situation. This NAIFA advocacy webinar, originally produced June 13 but now available on demand, gives you a better understanding of what is being dubbed the "Super Bowl of Tax" and provides insights into some of the proposals likely to shape the debate. It provides analysis of how the political landscape and upcoming election will shape the tax reform issue.

.png)

px.png)