On Tuesday, March 12, 2024, John Richardson and Mark Miller, members of NAIFA-Tennessee, showed the impact of grassroots advocacy by advocating against two sets of bills detrimental to the industry.

2 min read

NAIFA-Tennessee Grassroots Doubles the Impact

By NAIFA on 3/14/24 11:56 AM

Topics: State Advocacy Grassroots Legislative Day Insurance & Financial Advisor Regulation Tennessee

1 min read

Tennessee Adopts Legislation to Expand Producer Recruitment

By Bianca Alonso Weiss on 3/28/23 8:27 AM

Tennessee Governor Bill Lee signed SB 1369 into law on March 21, 2023, making Tennessee the 24th state to eliminate producer pre-licensing mandates. NAIFA-Tennessee applauds and thanks bill sponsors Senator Steve Southerland and Senator Ken Yager for carrying the legislation. NAIFA-Tennessee worked hard on the ground to educate lawmakers on the positive change this will be for increasing producer recruitment.

Topics: State Advocacy Licensing Supported Legislation Tennessee

1 min read

NAIFA-TN Blocks Bill That Would Have Required Agents to Share Clients' Personal Information

By NAIFA on 3/22/23 4:57 PM

Tennessee House Bill 1173 would have permitted funeral directors in some cases to obtain life insurance information – including the names of beneficiaries and policy benefits amounts – from insurance companies or agents. However, thanks to quick action by NAIFA-TN's grassroots and advocacy team, the House Insurance Subcommittee defeated the bill.

Topics: Life Insurance & Annuities State Advocacy Opposed Legislation Tennessee

2 min read

New Rule Strengthens Protections for Annuity Consumers in Tennessee

By NAIFA & ACLI on 1/27/23 10:33 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and NAIFA-TN President Scott Flowers issued the following joint statement on the best interest annuity rule adopted recently by the Tennessee Department of Commerce and Insurance:

“The new rule adopted by Director Carter Lawrence and the Tennessee Department of Commerce and Insurance advances important consumer safeguards and adds to the nationwide push for enhanced protections for annuity consumers.

“Tennessee becomes the 31st state to adopt the ‘best interest of consumer enhancements’ in the National Association of Insurance Commissioners (NAIC) Suitability in Annuity Transactions Model Regulation. These new laws and regulations also harmonize with the SEC’s Regulation Best Interest. They enhance the standards financial professionals must follow while safeguarding retirement savers’ access to, and information about, annuities, the only financial product in the marketplace that can provide guaranteed income for life.

“Unlike a fiduciary-only approach, these measures ensure that all savers, particularly financially vulnerable middle-income Americans, can get information about different choices for long-term security in retirement. A recent survey finds that middle-income retirement savers would be very concerned about a regulation keeping them from accessing the professional financial guidance they want and need.

“The U.S. Congress reaffirmed the importance of lifetime income when it passed legislation in 2019 and 2022 that made it easier for employers to include annuities in workplace retirement plans. These protections safeguard consumers while also ensuring that middle- and working-class families will retain access to easy-to-understand financial information.

“We hope that other states will follow Tennessee and implement these sensible protections so that more consumers can benefit from a best interest standard of care, no matter where they live.”

Topics: State Advocacy Standard of Care & Consumer Protection Interstate Advocacy Press Release Annuity Best Interest Tennessee

2 min read

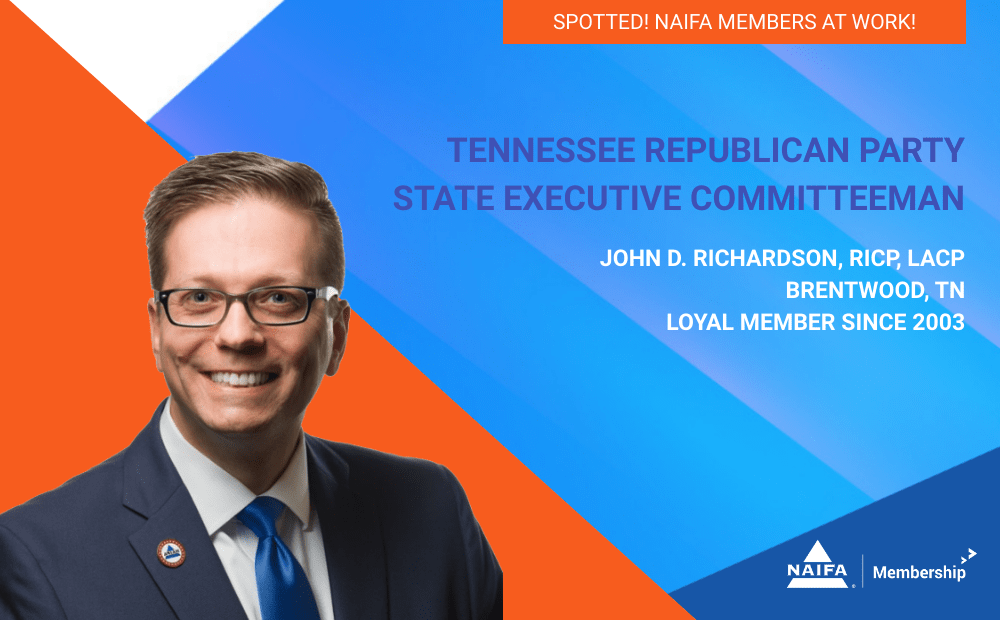

NAIFA-TN's John D. Richardson Elected to State Executive Committee

By NAIFA on 8/10/22 5:21 PM

John D. Richardson, RICP, LACP, loyal NAIFA member since 2003, was recently elected to serve on the Tennessee Republican Party State Executive Committee for Senate District 21.

Richardson's leadership and professional success have been noteworthy throughout his tenure as a NAIFA member. After graduating from the University of Tennessee-Knoxville with a B.A. in Political Science and a Minor in Spanish, he began his career as an advisor in 2005. Today he is a Financial Planner and Partner with Boundbrook Advisors (MassMutual), a firm he co-founded in Brentwood, TN.

Topics: State Advocacy Member Spotlight Tennessee

1 min read

Tennessee Modifies Qualifications for Potential Agents

By Bianca Alonso Weiss on 4/28/22 4:41 PM

NAIFA-TN is celebrating the recent signing of HB 2225 into law. Sponsored by Representative Dennis Powers and NAIFA-Tennessee member Senator Mark Pody, this bill limits the lookback of misdemeanors or Class E felonies to 10 years for insurance agent applicants. Class E felonies are often associated with low-quantity marijuana possession charges. In recent years, as many states have taken steps toward legalization, there are efforts to expunge or reconsider these types of crimes, which were disproportionately charged against minorities and people of color. HB 2225 is a step towards removing this barrier of entry into the insurance industry.

Topics: State Advocacy Insurance & Financial Advisor Regulation Producer Licensing & CE Tennessee

1 min read

NAIFA-TN Urges End of Professional Tax on Advisors and Broker-Dealers

By Julie Harrison on 3/2/21 3:55 PM

NAIFA-TN is using its advocacy muscle to convince state legislators to eradicate its professional privilege tax. The tax was used to balance budgets in 1992 and in 2002 and Tennessee is one of only six states with such a tax. Until two years ago, the tax applied to 22 different professions, including dentists, physicians, and real estate principal brokers. In 2019, Tennessee removed the discriminatory tax on 15 of the professions yet continues to require attorneys, securities agents, broker-dealers, investment advisers, lobbyists, osteopathic physicians, and physicians to pay the annual $400 tax.