The insurance and financial services industry uses technology to best serve clients and offer a broad range of products and services at affordable prices. However, a proposed rule by the Securities and Exchange Commission is “outright hostile to the use of technology,” according to a letter sent to SEC Secretary Vanessa Countryman by NAIFA and a group of coalition partners.

NAIFA

Recent posts by NAIFA

1 min read

Proposed SEC Rule Is Hostile to the Use of Technology

By NAIFA on 9/14/23 3:54 PM

Topics: Legislation & Regulations SEC FinTech

2 min read

NAIFA Seeks Middle Ground on STDLI Health Policies

By NAIFA on 9/12/23 5:25 PM

Short-term limited duration insurance (STLDI) is very important to many American families and individuals looking to fill gaps in their health insurance coverage and unable to access the individual health insurance marketplace. A current proposal by the administration would reduce the maximum allowable STLDI coverage period from 12 months to three months with a possible one-month renewal. People would be able to purchase a new STLDI policy from a different carrier, but would not be allowed to "stack" a new policy from the same carrier on an expiring policy.

Topics: Health Care Legislation & Regulations Taxes DOL Insurance & Financial Advisor Regulation

2 min read

NAIFA Is Well-Prepared to Oppose DOL's Fiduciary 2nd Act

By NAIFA on 9/11/23 4:52 PM

NAIFA has not been sitting idle as the Department of Labor made moves to propose a new fiduciary rule. In anticipation of the rulemaking, NAIFA helped the National Conference of Insurance Legislators (NCOIL) draft a resolution that opposes the DOL's new fiduciary rule as unnecessary and likely harmful to consumers. The resolution, which NCOIL adopted in July after NAIFA testified at the Conference's 2023 Summer Meeting, states: "NCOIL urges the DOL to refrain from further rulemaking that would revive all or parts of the 2016 Fiduciary Rule" and "...urges state legislators and other interested stakeholders to join in opposition to any further rulemaking by DOL reviving the 2016 Fiduciary Rule."

Topics: Legislation & Regulations Federal Advocacy DOL Regulation Best Interest Fiduciary

1 min read

Connect With Clients While You Help NAIFA Get Out the Vote

By NAIFA on 9/8/23 2:45 PM

NAIFA encourages all insurance and financial professionals to vote in local, state, and federal elections and to encourage others to follow their example. Approximately 63 million Americans who are eligible are not even registered to vote. Encouraging your colleagues, team, and clients to register is a great first step and a way to show your dedication to participating in the democratic process.

Topics: Advocacy Get Out the Vote

2 min read

NAIFA Applauds IRS Move on Retirement Plan Catch-Up Contributions

By NAIFA on 8/28/23 12:55 PM

Retirement planners can breathe a sigh of relief.

The IRS has delayed implementing a provision of the SECURE 2.0 legislation that would require retirement plan catch-up contributions by high-income earners to be made as after-tax Roth-style contributions rather than pretax contributions. The legislative language states that the change is effective after 2023, which would have presented unworkable communications, record-keeping, and implementation challenges to plan sponsors and participants as well as advisors. Prior to this fix, some plan sponsors had said they would likely have to eliminate the ability of employees to make catch-up contributions.

Topics: Retirement Planning Congress IRS Individual Retirement Accounts

1 min read

California Insurance Department FAQ Aims to Clear Up Confusion About LTCi Program Study

By NAIFA on 8/18/23 3:03 PM

California has not at this time established a publicly funded state-run long-term care insurance program or set deadlines for employees in the state to opt out. The state established a Task Force to study the possibility of such a program and make recommendations, and that study is ongoing. The California Department of Insurance has issued a revised Frequently Asked Questions Document to clear up some common misconceptions. Among topics covered by the FAQ are:

Topics: Long-Term Care Insurance State Advocacy Limited & Extended Care Planning Center California

1 min read

Happy Birthday to IFAPAC

By NAIFA on 8/18/23 8:54 AM

On August 18, 1966, NAIFA formed the Insurance and Financial Advisors Political Action Committee (IFAPAC) as a nonprofit, nonpartisan organization. Then known as LUPAC, it was created "to engage in voter registration and get-out-the-vote campaigns, compile voting records of individual members of Congress, and implement nonpartisan courses designed to stimulate citizen involvement in politics," according to NAIFA's magazine at the time. The PAC also solicited "contributions to aid selected Congressional candidates," the publication said.

Topics: State Advocacy Federal Advocacy IFAPAC

1 min read

Take Me Out to the Advocacy Opportunity

By NAIFA on 8/11/23 3:54 PM

When we think of the In-District Meetings NAIFA promotes each August, we usually think of get-togethers at district offices with federal lawmakers or their staff. But really, they can take all shapes and forms.

Topics: State Advocacy Financial Literacy

2 min read

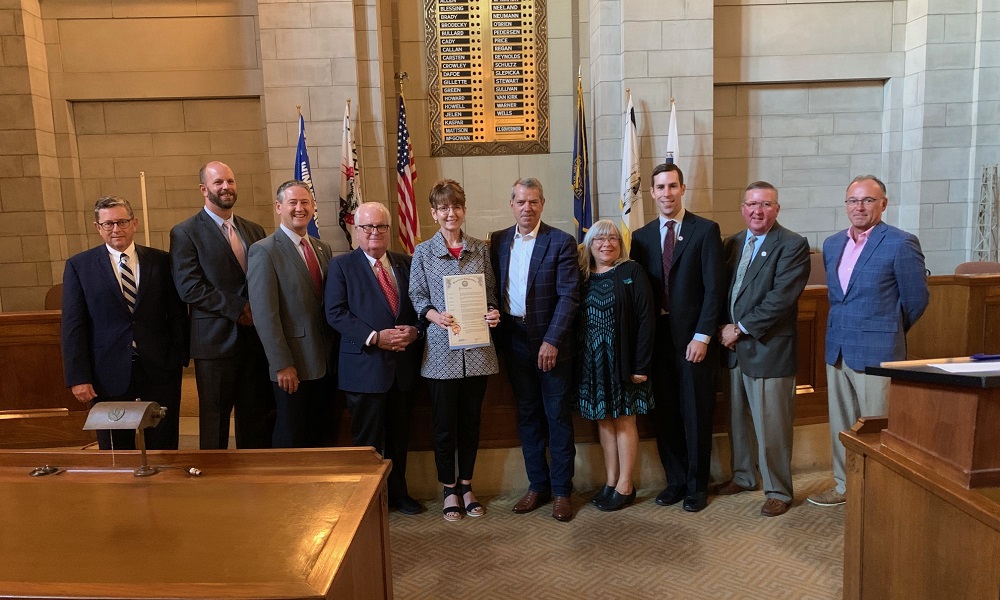

NAIFA-NE Promotes Life Insurance Awareness With Governor Pillen

By NAIFA on 8/8/23 9:07 AM

NAIFA's Nebraska chapter has been a strong advocate for the life insurance industry, working with state officials to proclaim September Life Insurance Awareness Month (LIAM) in the state. Their efforts were successful and several members of the association were on hand at the ceremony when Governor Jim Pillen issued the proclamation.

Topics: Life Insurance & Annuities Life Insurance Awareness Month State Advocacy Nebraska

2 min read

NAIFA Members’ Powerful Grassroots Message for Financial Security Hits Home

By NAIFA on 8/1/23 1:50 PM

Congress has begun its August recess, and members of the National Association of Insurance and Financial Advisors (NAIFA) are capitalizing on lawmakers’ annual working session in their home districts by meeting with their Representatives and Senators to strengthen grassroots relationships and discuss issues important to financial professionals and their clients.

.png)

.png)