NAIFA-MA is celebrating a major advocacy win after a very close call. During the last three days of the legislative session which concluded July 31, the General Court introduced H. 5123 which would have implemented a two-year pilot program to extend eligibility for premium assistance payments on point of service cost-sharing subsidies for certain health insurance applicants. In short, this legislation would have implemented a pilot single-payer health coverage program, thus having a catastrophic impact on employer-sponsored health plans.

NAIFA

Recent posts by NAIFA

1 min read

Quick Action Leads to NAIFA-MA Advocacy Win

By NAIFA on 8/11/22 10:03 AM

Topics: Health Care State Advocacy Massachusetts

2 min read

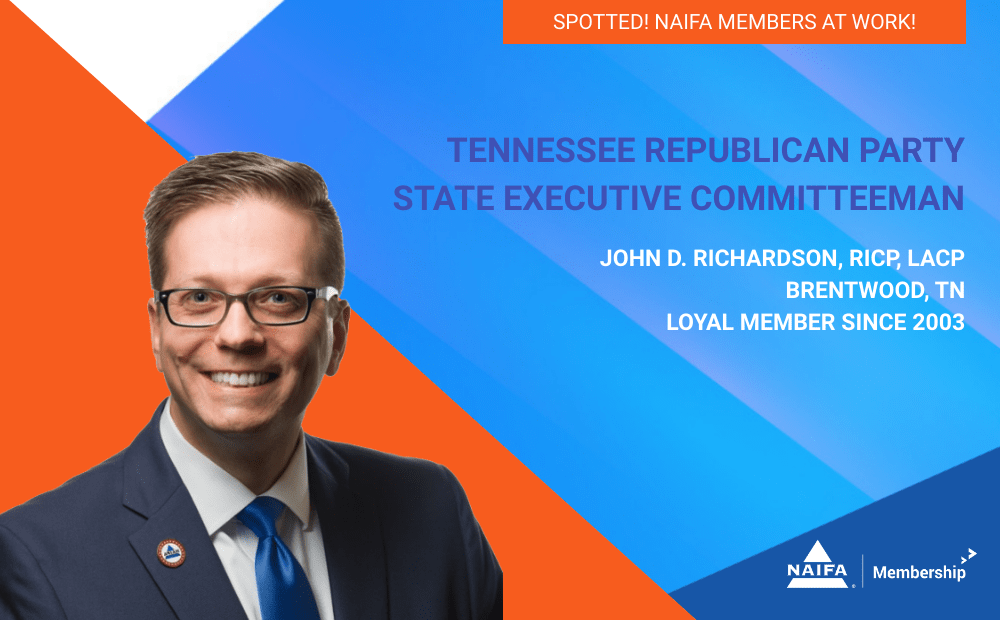

NAIFA-TN's John D. Richardson Elected to State Executive Committee

By NAIFA on 8/10/22 5:21 PM

John D. Richardson, RICP, LACP, loyal NAIFA member since 2003, was recently elected to serve on the Tennessee Republican Party State Executive Committee for Senate District 21.

Richardson's leadership and professional success have been noteworthy throughout his tenure as a NAIFA member. After graduating from the University of Tennessee-Knoxville with a B.A. in Political Science and a Minor in Spanish, he began his career as an advisor in 2005. Today he is a Financial Planner and Partner with Boundbrook Advisors (MassMutual), a firm he co-founded in Brentwood, TN.

Topics: State Advocacy Member Spotlight Tennessee

1 min read

NAIFA Favors Federal Privacy Protections But Urges Changes to Draft Proposal

By NAIFA on 7/19/22 5:45 PM

NAIFA and other trade associations have sent a letter to influential members of the House Energy and Commerce Committee expressing concerns with the discussion draft of the American Data Privacy and Protection Act, which is a national uniform privacy law proposal.

NAIFA supports federal laws and regulations protecting the confidentiality of personal information and believes policy at the federal level will help avoid problems a variety of confusing and potentially contradictory state laws would cause. NAIFA members provide financial products, services, and advice to Main Street American families and businesses. Their clients entrust them with sensitive personal information, so it is among the highest priorities for our industry that we keep that information secure.

Topics: Federal Advocacy Congress

Get Out the Vote Resources Now Available

By NAIFA on 7/18/22 10:00 AM

Whether you're new to political advocacy or a grassroots leader, NAIFA's Get Out the Vote is a great resource for everything you need to know about NAIFA's political advocacy. Find information on polling dates and locations, ballot measures, and your elected officials. Brush up on Government 101 or find the text of individual bills—this site has useful information for everyone.

Topics: State Advocacy Federal Advocacy Grassroots

3 min read

NAIFA Expands its Diversity, Equity, and Inclusion Efforts through New Outreach to Financial Services Professionals and Prospective Professionals

By NAIFA on 7/15/22 7:47 AM

NAIFA Invites Women and Hispanic Agents and Advisors to Two New Programs in August

The National Association of Insurance and Financial Advisors (NAIFA) has announced the addition of two programs that will run on Tuesday, August 16th pre-conference to its upcoming Apex event being held in Phoenix, Arizona. The sessions focus on raising awareness for state, interstate, and federal advocacy and stress the importance of financial advisors to get involved, starting with voting, in the political process.

Topics: Diversity State Advocacy Federal Advocacy

1 min read

NAIFA's O'Gara Asks DOL to Preserve Advisors' Independent Status

By NAIFA on 6/30/22 12:03 PM

Josh O'Gara, CLU, ChFC, CFP, loyal member since 2011, spoke on behalf of NAIFA during the U.S. Department of Labor's virtual public forum on the classification of employees and independent contractors under the Fair Labor Standards Act. NAIFA strongly supports an exemption for insurance and financial professionals under any legislation or DOL regulation that would reclassify independent contractors as employees.

Topics: Federal Advocacy Grassroots DOL

1 min read

SECURE 2.0 Takes Next Step Toward Enactment

By NAIFA on 6/21/22 3:42 PM

NAIFA and other interested parties sent a letter of appreciation to the Senate Finance Committee Chairman Wyden (D-OR) and Ranking Member Mike Crapo (R-ID) for their leadership in releasing the Enhancing American Retirement Now (EARN) Act, which would enhance retirement security for many Americans.

Topics: Retirement Planning Federal Advocacy Congress Supported Legislation

1 min read

Michigan Passes High School Financial Literacy Education Requirement

By NAIFA on 6/21/22 10:49 AM

NAIFA is proud that Michigan is the 14th state to embrace a personal finance education course requirement. Michigan's legislation requires that all high school students take a half-credit course in personal finance before they graduate. The Michigan House of Representatives passed HB 5190 by a vote of 94-13 and the bill passed the state's Senate in May with a vote of 35-2. Members of NAIFA-Michigan, who first created this concept a decade ago with legislation to create optional courses, celebrate the signature of Governor Whitmer updating Michigan’s high school curriculum to include a financial literacy course.

Topics: State Advocacy Financial Literacy Michigan

3 min read

Senate Committee Advances NAIFA-Supported Retirement Legislation

By NAIFA on 6/15/22 3:59 PM

NAIFA joined other industry organizations in sending a letter to Senators Patty Murray (D-WA) and Richard Burr (R-NC), the Chair and Ranking Member, respectively, of the Senate Committee on Health, Education, Labor and Pensions, thanking them for their bipartisan support for retirement-reform legislation.

Topics: Retirement Planning Federal Advocacy Congress Supported Legislation

2 min read

NAIFA Celebrates State Advocacy Milestone

By NAIFA on 5/26/22 2:24 PM

NAIFA strongly encourages states to adopt the NAIC's model regulation on annuity transactions, and our state chapters have made promoting adoption of the model an advocacy priority over the past two years. Our efforts, the work of members like you at the grassroots level, and our ability to work with other industry organizations – including the American Council of Life Insurers – have paid off.