Josh O'Gara, CLU, ChFC, CFP, loyal member since 2011, spoke on behalf of NAIFA during a virtual roundtable discussion on Department of Labor’s proposed rule on Independent Contractor Classification Under the Fair Labor Standards Act. The event was held by the U.S. Small Business Administration’s Office of Advocacy to gather input from people and businesses potentially affected by the proposed rule. NAIFA strongly supports an exemption for insurance and financial professionals under any legislation or DOL regulation that would reclassify independent contractors as employees.

2 min read

NAIFA's O'Gara Tells the SBA It's Important for Advisors to Remain Independent Contractors

By NAIFA on 11/10/22 12:31 PM

Topics: Federal Advocacy

It's Election Day

By NAIFA on 11/8/22 12:30 AM

It's Election Day! NAIFA encourages everyone to get out and vote (if you haven't voted already). The results of this election is likely to have profound implications for your business and clients.

Topics: Federal Advocacy

2 min read

Alaska Adopts Stronger Safeguards for Annuity Consumers

By American Council of Life Insurers on 10/31/22 11:01 AM

American Council of Life Insurers (ACLI) President and CEO Susan Neely and National Association of Insurance and Financial Advisors (NAIFA)-Alaska Vice President of Advocacy, Lanet Spence, issued the following joint statement on the best interest annuity rule adopted recently by the Alaska Division of Insurance:

Topics: State Advocacy Standard of Care & Consumer Protection Insurance & Financial Advisor Regulation

2 min read

CMS Issues FAQs to Address the Recording of Calls by Agents and Brokers

By Mike Hedge on 10/21/22 5:43 PM

In May, the Centers for Medicare and Medicaid Services (CMS) issued a Final Rule which revises the Medicare Advantage (Part C) program and the Medicare Prescription Drug Benefit (Part D) program regulations to implement changes related to marketing and communications, past performance, Star Ratings, network adequacy, medical loss ratio reporting, special requirements during disasters or public emergencies, and pharmacy price concessions.

Topics: Medicare Federal Advocacy

3 min read

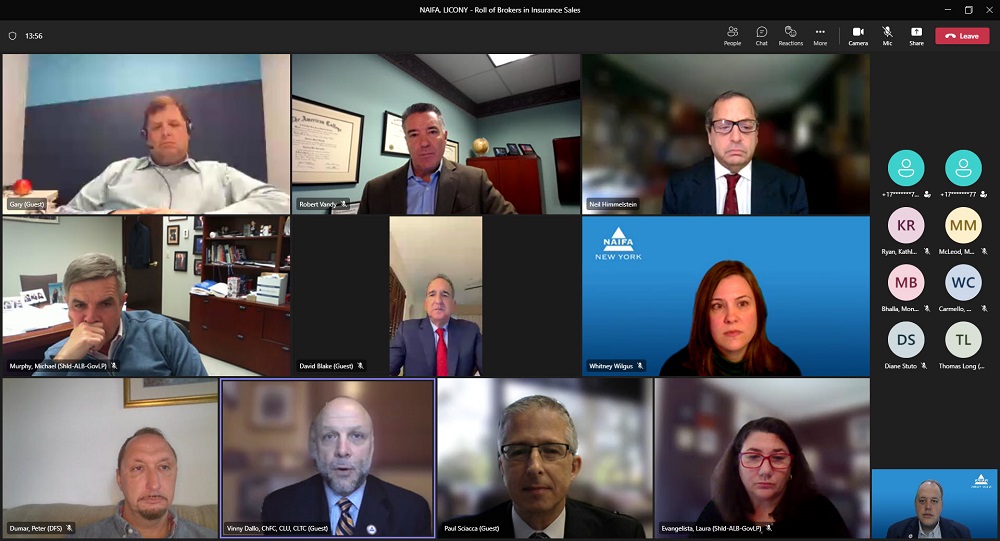

NAIFA-NY Members Meet With DFS Officials to Address Challenges Serving Clients in the State

By NAIFA on 10/20/22 2:06 PM

Members of NAIFA’s New York chapter (NAIFA-NY) held a virtual meeting with officials from the state Department of Financial Services (DFS). State President Gary Cappon, CLU, LUTCF, RICP, FSCP, CLTC, provided introductions and a brief rundown of NAIFA’s advocacy work and support for the agent and advisor community and the consumers they serve. He also discussed challenges with financial product availability in the state. President-Elect Vinny Dallo, ChFC, CLU, CLTC, LUTCF, and Vice President of Advocacy Paul Sciacca presented “A Day in the Life of a Financial Professional,” highlighting how NAIFA members serve families and businesses in the state.

Topics: Legislation & Regulations State Advocacy Press Release

3 min read

Robert A. Miller to Receive NAIFA’s Terry Headley Lifetime Defender Award

By NAIFA on 10/18/22 10:00 AM

NAIFA is proud to announce that Robert A. Miller, M.S., M.A., Partner at Miller-Pomerantz Insurance and Financial Services in New York City, is the recipient of NAIFA’s Terry Headley Lifetime Defender Award.

Miller, a loyal member since 1983, was NAIFA’s national President for the 2011-2012 term. He had previously served as President of the NAIFA-New York state chapter and NAIFA-New York City. He was elected to the NAIFA Board of Trustees in 2005 and has served as trustee liaison to the CEO Outreach Program, the Young Advisor Team, and the Corporate Partnerships Program. He also served as chair of the NAIFA Governance Committee and was a member of the NAIFA Finance Committee.

Topics: Advocacy Awards Press Release IFAPAC

2 min read

NAIFA’s Advocacy Highlighted at LICONY Meeting

By NAIFA on 10/13/22 2:33 PM

NAIFA Senior Vice President for Government Relations Diane Boyle appeared with other industry thought leaders on the National & Federal Insurance Perspective Panel at the Life Insurance Council of New York (LICONY) Annual Meeting and Planning Conference in Albany. She discussed with other panelists the top issues facing the insurance and financial services industry, the promotion of diversity and inclusion in the insurance sector, issues caused by the COVID-19 pandemic, and NAIFA’s work with the American Council of Life Insurance (ACLI) to remove unnecessary barriers to recruiting new insurance professionals.

Topics: Diversity Press Release New York Federal Advocacy

1 min read

NAIFA Evaluating Proposed DOL Rule for Independent Contractors

By Michael Hedge, NAIFA's Director of Government Relations on 10/11/22 5:12 PM

On Tuesday, October 11, 2022, the Department of Labor (DOL) released a proposed rule that would replace the existing 2021 test under the Fair Labor Standards Act used to determine worker classification as either an independent contractor or an employee.

Topics: Legislation & Regulations

1 min read

NAIFA Looks to Work With Lisa Gomez, New Assistant Secretary of Labor for EBSA

By Diane Boyle on 9/30/22 8:49 AM

NAIFA congratulates Lisa Gomez on her confirmation as Assistant Secretary of Labor for the Employee Benefits Security Administration (EBSA).

Topics: Standard of Care & Consumer Protection Press Release Federal Advocacy

1 min read

NAIFA Partners With BIPAC to Support Employee Voter Registration Week

By NAIFA on 9/27/22 5:32 PM

NAIFA is excited to partner with BIPAC to support Employee Voter Registration Week.