NAIFA-UT recently took advantage of the August Congressional recess to hold a very successful Legislative Day. More than 50 NAIFA members were in attendance along with Representatives Burgess Owens, Chris Stewart, and Blake Moore. Also attending was a staff member from Senator Mike Lee’s office. Representative John Curtis had a prior commitment but addressed the audience via video.

2 min read

NAIFA-Utah Members Meet With Lawmakers at In-State Event

By NAIFA on 8/17/22 3:51 PM

Topics: Member Spotlight Federal Advocacy Grassroots Utah

3 min read

NAIFA Sends Letters to CMS to Lessen the Impact of CMS Final Rule

By Michael Hedge, NAIFA's Director of Government Relations on 8/15/22 3:01 PM

In May, the Centers for Medicare and Medicaid Services (CMS) issued a Final Rule which revises the Medicare Advantage (Part C) program and the Medicare Prescription Drug Benefit (Part D) program regulations to implement changes related to marketing and communications, past performance, Star Ratings, network adequacy, medical loss ratio reporting, special requirements during disasters or public emergencies, and pharmacy price concessions.

Topics: Medicare Federal Advocacy CMS Producer Sales & Marketing

3 min read

In-District Meetings Are Underway

By NAIFA on 8/11/22 4:11 PM

When Congress is in recess, like it is right now, NAIFA's grassroots advocacy actually picks up. NAIFA members across the country are meeting with their Representatives and Senators in their home districts this August.

NAIFA's yearlong grassroots strategy encourages multiple in-person connections with lawmakers, including at NAIFA's May Congressional Conference, in-person meetings during the August recess, a day on the Hill during NAIFA's fall/winter National Leadership Conference, and at community and fundraising events throughout the year.

Topics: Federal Advocacy Grassroots

1 min read

Quick Action Leads to NAIFA-MA Advocacy Win

By NAIFA on 8/11/22 10:03 AM

NAIFA-MA is celebrating a major advocacy win after a very close call. During the last three days of the legislative session which concluded July 31, the General Court introduced H. 5123 which would have implemented a two-year pilot program to extend eligibility for premium assistance payments on point of service cost-sharing subsidies for certain health insurance applicants. In short, this legislation would have implemented a pilot single-payer health coverage program, thus having a catastrophic impact on employer-sponsored health plans.

Topics: Health Care State Advocacy Massachusetts

2 min read

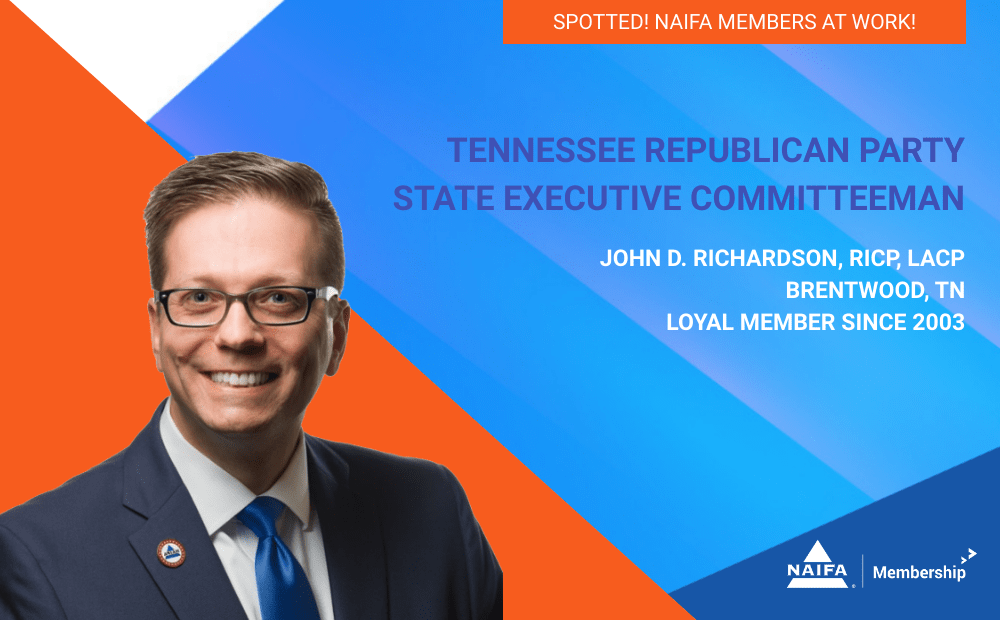

NAIFA-TN's John D. Richardson Elected to State Executive Committee

By NAIFA on 8/10/22 5:21 PM

John D. Richardson, RICP, LACP, loyal NAIFA member since 2003, was recently elected to serve on the Tennessee Republican Party State Executive Committee for Senate District 21.

Richardson's leadership and professional success have been noteworthy throughout his tenure as a NAIFA member. After graduating from the University of Tennessee-Knoxville with a B.A. in Political Science and a Minor in Spanish, he began his career as an advisor in 2005. Today he is a Financial Planner and Partner with Boundbrook Advisors (MassMutual), a firm he co-founded in Brentwood, TN.

Topics: State Advocacy Member Spotlight Tennessee

2 min read

Colorado Adopts Stronger Protections for Annuity Consumers

By NAIFA & ACLI on 8/5/22 1:33 PM

ACLI President and CEO Susan Neely and NAIFA-CO Political Action Committee Chair and Government Relations Committee member Brent Jones issued the following joint statement on the best interest annuity rule adopted recently by the Colorado Division of Insurance:

Topics: State Advocacy Standard of Care & Consumer Protection Colorado Annuity Best Interest

1 min read

House Committee Passes Bill Revising Process for Registering Index-Linked Annuities

By Michael Hedge, NAIFA's Director of Government Relations on 7/28/22 12:00 PM

On July 28, the House Financial Services Committee voted to advance a bipartisan bill requiring the Securities and Exchange Commission to create a new form for registering index-linked annuities, which allows investors to save for retirement in a more streamlined process.

Topics: Life Insurance & Annuities Federal Advocacy Congress

1 min read

House Passes Remote Notarization Legislation

By Michael Hedge, NAIFA's Director of Government Relations on 7/27/22 12:00 PM

On July 27, the House of Representatives passed H.R.3962 the Securing and Enabling Commerce Using Remote and Electronic Notarization Act (the SECURE Notarization Act). The bill authorizes a notary public to notarize electronic records related to interstate commerce remotely, subject to specified procedures.

Topics: Federal Advocacy Congress Supported Legislation Remote Notarization Producer Sales & Marketing

2 min read

NAIFA Works to Lessen the Impact of CMS Final Rule

By Mike Hedge on 7/26/22 11:37 AM

In May, the Centers for Medicare and Medicaid Services (CMS) issued a Final Rule which revises the Medicare Advantage (Part C) program and the Medicare Prescription Drug Benefit (Part D) program regulations to implement changes related to marketing and communications, past performance, Star Ratings, network adequacy, medical loss ratio reporting, special requirements during disasters or public emergencies, and pharmacy price concessions.

Topics: Health Care Medicare Federal Advocacy CMS Producer Sales & Marketing

2 min read

Advocacy Rewind: Spotlight on NAIFA-Nebraska

By Bianca Alonso Weiss on 7/25/22 5:41 PM

On March 1, 2022, NAIFA-Nebraska hosted their successful Legislative Day event in Lincoln. NAIFA-NE members in attendance received briefings from: