NAIFA has signed on as an official partner for Employee Voter Registration Week, which will take place from September 27 to October 1. During this week, NAIFA along with other companies and trade associations will be active on social media encouraging stakeholders and employees across the country to get registered to vote in the upcoming elections.

1 min read

NAIFA Supports Employee Voter Registration Week

By Kim Durcho on 9/9/21 4:11 PM

Topics: State Advocacy Federal Advocacy Grassroots

2 min read

NAIFA-Dallas Hosts Legislative Luncheon

By NAIFA on 8/31/21 2:04 PM

NAIFA’s Dallas chapter recently held its annual legislative luncheon. During the event, NAIFA members met with federal and state legislators and their staff and shared key NAIFA advocacy messages. NAIFA-TX lobbyist Elizabeth Hadley and NAIFA’s national Government Relations Director Mike Hedge joined the event and gave a legislative update via Zoom.

Topics: State Advocacy NAIFA-Dallas Grassroots Legislative Day Texas

1 min read

CMS Plan Year 2022 Registration and Training is Live for Returning Agents and Brokers

By NAIFA Government Relations Team on 8/30/21 5:24 PM

Today, the Centers for Medicare and Medicaid Services (CMS) announced that registration and training for Plan Year 2022 is now available for returning agents/brokers who completed training and registration for Plan Year 2021. Registration and full training for new agents and brokers will be made available later this year.

Topics: Federal Advocacy CMS Insurance & Financial Advisor Regulation Producer Sales & Marketing

Take the 2021 NAIFA Workforce Survey

By NAIFA on 8/29/21 10:15 PM

NAIFA members are our association's advocacy strength. We are influential with lawmakers at state and federal levels because we have members from every congressional district in the United States who serve Main Street Americans. Policymakers want to hear NAIFA members' stories and respect our expertise because we represent the communities, families, and small businesses important to elected officials.

Topics: Federal Advocacy Insurance & Financial Advisor Regulation Producer Employment

2 min read

NAIFA-WI Builds Advocacy Momentum With In-District Events

By NAIFA on 8/24/21 10:02 AM

Politically active members of NAIFA's Wisconsin chapter have maintained NAIFA's grassroots advocacy push throughout June, July, and August. According to NAIFA Senior Vice President for Government Relations Diane Boyle, NAIFA-WI leads all NAIFA's state chapters in in-district meetings with lawmakers and their staff this summer.

Topics: Wisconsin Federal Advocacy Grassroots

1 min read

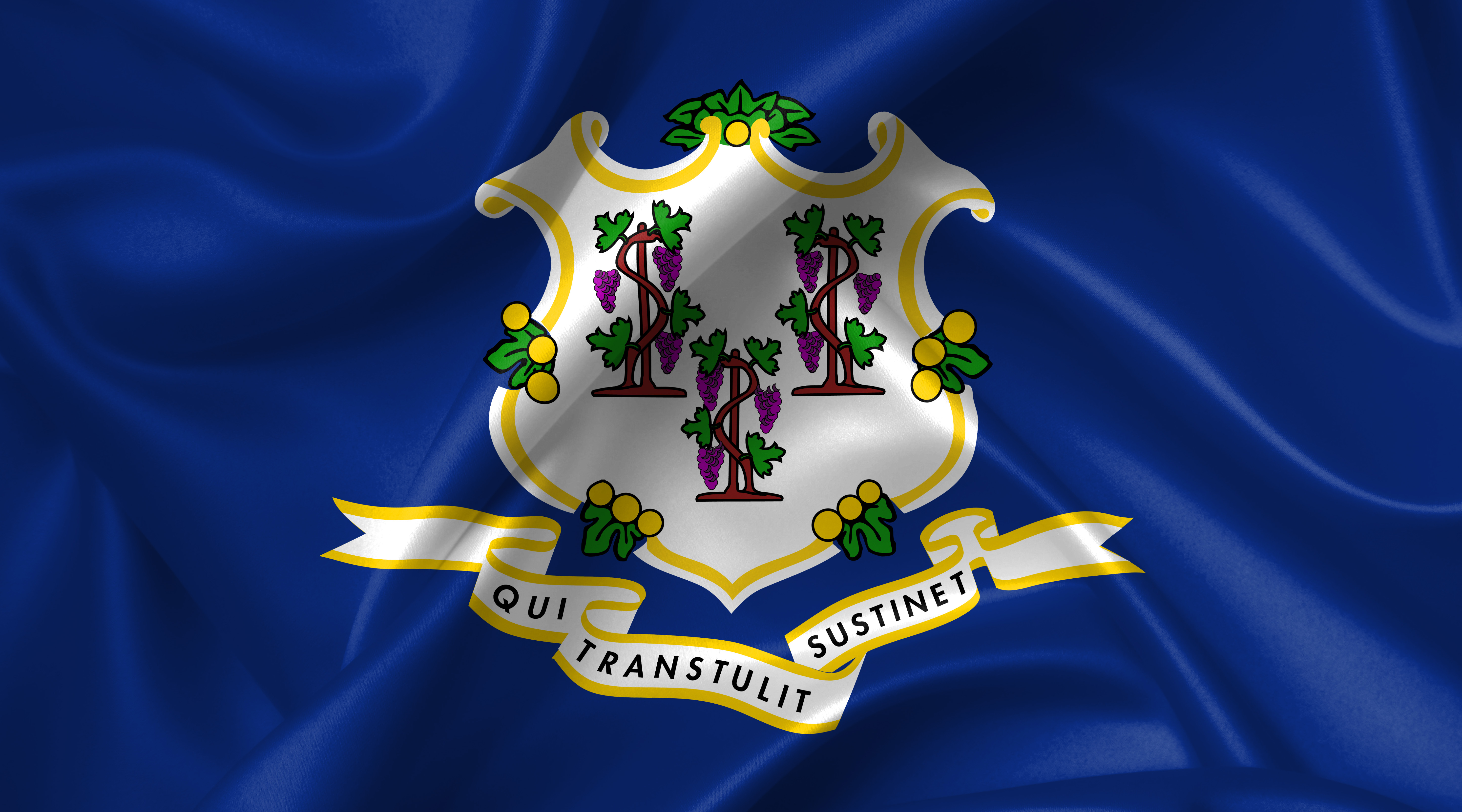

Connecticut Is the 16th State to Adopt the NAIC's Best Interest Model

By NAIFA on 8/18/21 4:46 PM

Connecticut has become the 16th state to adopt consumer-protection regulations or legislation based on the National Association of Insurance Commissioners’ (NAIC’s) Suitability in Annuity Transactions Model. The NAIC model requires financial professionals to work in the best interests of their clients during annuities transactions and aligns with the federal Securities and Exchange Commission’s Regulation Best Interest. It also preserves the ability of consumers to work with agents and advisors offering a variety of successful business models and avoids restrictions that would likely make it impossible for financial professionals to work with Main Street investors and retirement savers.

Topics: State Advocacy Standard of Care & Consumer Protection Annuity Best Interest Connecticut Insurance & Financial Advisor Regulation

1 min read

NAIFA Advocacy Goes to the District Level During Congressional Break

By NAIFA on 8/17/21 3:01 PM

Congress is out of session for its annual August recess, which means that NAIFA members across the country are taking advantage of the opportunity to meet hold in-district meetings with lawmakers and their staff. NAIFA is the leading grassroots organization for insurance and financial professionals with members in every congressional district. Every year, NAIFA encourages members to meet with their Representatives and Senators during the August recess to reinforce the advocacy message shared at NAIFA’s May Congressional Conference.

Topics: Federal Advocacy Grassroots Congress

1 min read

NAIFA Supports Bill to Reform Index-Linked Annuities Registration

By Mike Hedge on 8/16/21 9:39 AM

A bipartisan bill to direct the Securities and Exchange Commission to issue a new form for annuity issuers to use when filing registered index-linked annuities has been reintroduced in the House.

Topics: Life Insurance & Annuities Federal Advocacy Congress Supported Legislation

1 min read

NAIFA to Present Terry Headley Lifetime Defender Award to Member Exhibiting Advocacy Excellence

By NAIFA on 8/11/21 4:25 PM

NAIFA has announced the inaugural Terry Headley Lifetime Defender Award, which will recognize a current NAIFA member who shows exemplary service to their profession, colleagues, and clients through their political advocacy and contributions to IFAPAC.

Topics: IFAPAC

1 min read

GAO Audit Finds Health Agents Act Appropriately

By NAIFA on 8/11/21 2:35 PM

Agents and advisors are an important resource for consumers seeking affordable health care plans that suit their individual needs. These professionals have expertise and experience to help individuals and families navigate the complicated health care system and compare plan options. Consumers looking for an advisor can use NAIFA's "Find an Advisor" tool.