NAIFA's Congressional Conference shines a spotlight on NAIFA's unmatched advocacy influence and provides financial professionals with another way to serve clients' best interests. NAIFA members who meet with their members of Congress this May will not only be advocating for their own businesses but also for their colleagues, clients, and communities. Decisions made in Washinton, D.C., affect families and businesses nationwide that rely on NAIFA members for financial guidance.

1 min read

Register Today! NAIFA's Congressional Conference Is a Can't-Miss Event

By NAIFA on 2/18/24 5:31 PM

Topics: Grassroots Congress Congressional Conference

2 min read

NAIFA Seeks Legislation to Solidify the State-Based Regulation of Insurance

By NAIFA on 1/11/24 4:08 PM

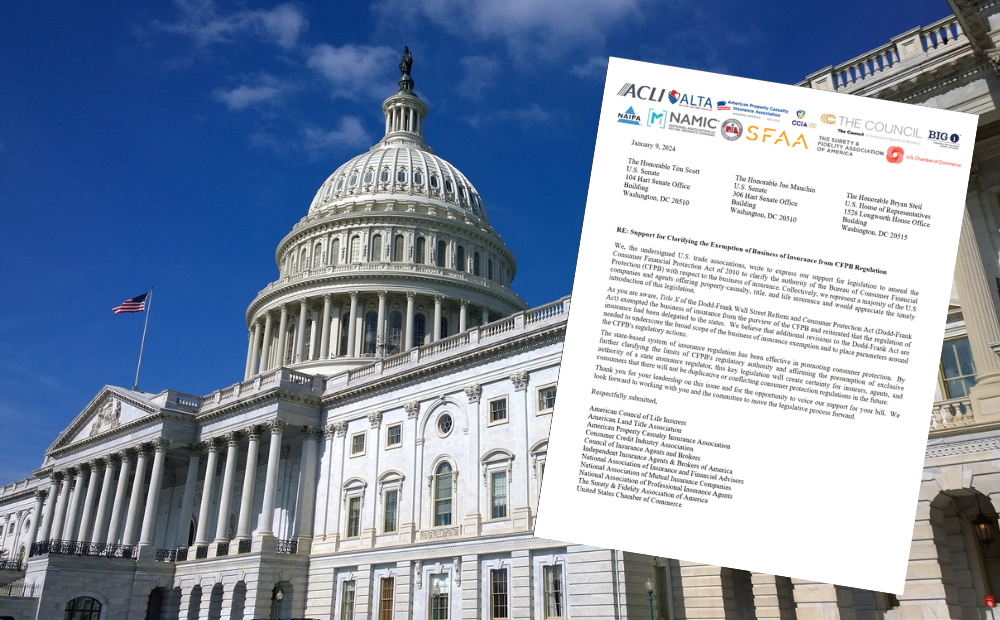

State-based regulation of insurance has been a bedrock of the industry and effectively protects the interests of consumers. Federal law, including Title X of the Dodd-Frank Wall Street Reform and Consumer Protection Act, recognizes this fact and explicitly exempts the business of insurance from regulation by federal Bureau of Consumer Financial Protection (BCFP).

NAIFA and a coalition of groups representing a majority of the U.S. companies and agents offering property-casualty, title, and life insurance have asked Congress for additional legislation that would clarify provisions in Dodd-Frank and solidify the state-based system of insurance regulation.

Topics: Federal Advocacy Congress Insurance & Financial Advisor Regulation Supported Legislation

2 min read

NAIFA Supports the Congressional Financial Literacy and Wealth Creation Caucus

By NAIFA on 10/20/23 3:55 PM

NAIFA is a strong proponent of the Congressional Financial Literacy and Wealth Creation Caucus and has urged members of Congress to join during the Congressional Conference and In-District Meetings earlier this year. The bipartisan caucus raises issues important to NAIFA members and consumers they serve in the consciousness of lawmakers. Its members are legislators "committed to empowering Americans with the tools needed to build wealth and achieve financial stability."

Topics: Financial Literacy Federal Advocacy Congress

7 min read

More Than 135 In-District Meetings Illustrate NAIFA's Grassroots Impact

By NAIFA on 9/22/23 1:59 PM

NAIFA members held more than 135 In-District Meetings with federal lawmakers and senior staff during the recent Congressional recess. This is the second post-COVID year in a row that the number of meetings has reached triple digits. In addition, many NAIFA members also met with state officials over the summer.

Topics: Federal Advocacy Grassroots Congress August In-Districts

2 min read

NAIFA Applauds IRS Move on Retirement Plan Catch-Up Contributions

By NAIFA on 8/28/23 12:55 PM

Retirement planners can breathe a sigh of relief.

The IRS has delayed implementing a provision of the SECURE 2.0 legislation that would require retirement plan catch-up contributions by high-income earners to be made as after-tax Roth-style contributions rather than pretax contributions. The legislative language states that the change is effective after 2023, which would have presented unworkable communications, record-keeping, and implementation challenges to plan sponsors and participants as well as advisors. Prior to this fix, some plan sponsors had said they would likely have to eliminate the ability of employees to make catch-up contributions.

Topics: Retirement Planning Congress IRS Individual Retirement Accounts

2 min read

NAIFA Members’ Powerful Grassroots Message for Financial Security Hits Home

By NAIFA on 8/1/23 1:50 PM

Congress has begun its August recess, and members of the National Association of Insurance and Financial Advisors (NAIFA) are capitalizing on lawmakers’ annual working session in their home districts by meeting with their Representatives and Senators to strengthen grassroots relationships and discuss issues important to financial professionals and their clients.

Topics: Press Release Grassroots Congress

1 min read

NAIFA to Keep Grassroots Momentum Going in In-District Meetings

By NAIFA on 6/21/23 4:01 PM

Each year, NAIFA capitalizes on the grassroots momentum created by our state chapters' Legislative Days and the national Congressional Conference by coordinating in-district meetings with members of Congress during the August legislative recess. You should be a part of it and invite colleagues to join, too.

Topics: Grassroots Congress

3 min read

NAIFA Supports New Congressional Caucus to Promote Financial Security

By NAIFA on 4/14/23 4:18 PM

NAIFA applauds the leadership of Representatives Young Kim (R-CA) and Joyce Beatty (D-OH) on the relaunch of the Congressional Financial Literacy and Wealth Creation Caucus for the 118th Congress. The Congresswomen are an excellent duo to co-chair this bipartisan group of legislators committed to empowering Americans with the tools needed to build wealth and achieve financial stability.

Topics: Financial Literacy Financial Security Federal Advocacy Congress Congressional Conference

1 min read

NAIFA Supports Legislation to Address Financial Exploitation of Seniors

By Mike Hedge on 1/31/23 4:14 PM

The U.S. House of Representatives passed H.R.500, the Financial Exploitation Prevention Act of 2023, by a bipartisan vote of 419-0 on January 30. H.R. 500 was introduced by Rep. Ann Wagner, (R-MO), Chairwoman of the House Financial Services subcommittee on Capital Markets.

Topics: Legislation & Regulations Federal Advocacy Congress Supported Legislation Senior Financial Protection

1 min read

NAIFA's Mayeux Contributes to Article Supporting Remote Online Notarization Bill

By NAIFA on 8/19/22 11:39 AM

NAIFA CEO Kevin Mayeux is a contributing author of an article in the publication Real Clear Policy arguing in favor of federal legislation allowing remote online notarization (RON). NAIFA has been a strong proponent of RON and urged passage of the SECURE Notarization Act because it would set a national standard and be a great benefit to NAIFA members and their clients who routinely complete financial transactions that require notarized documents.

.png)

.png)